Emerita Resources Corp. (TSXV: EMO) — Eric Sprott, through 2176423 Ontario Ltd., has acquired 4.76 million units of Emerita Resources in a private placement at $1.05 per unit, totaling just under $5 million. With this move, Sprott’s position increases to 25.2 million shares and 2.38 million warrants, representing 8.7% ownership on a non-diluted basis and 9.5% on a partially diluted basis, though still under the 10% insider threshold. The financing strengthens Emerita’s balance sheet while signaling continued institutional confidence, though Sprott’s status as an insider ceases as a result of dilution effects. Emerita raised CAD $25m in the financing with a verdict in their big lawsuit on the way.

LibertyStream Infrastructure Partners Inc. (TSXV: LIB | OTCQB: VLTLF | FSE: I2D) (formerly Volt Lithium)— LibertyStream has completed construction of its commercial lithium carbonate refining unit, which is now en route to its Texas field operations. The modular facility is designed to produce up to 10 tonnes per year of lithium carbonate, adjustable to either industrial- or battery-grade quality. Once commissioned, the unit will enable the company to generate bulk samples directly from oilfield brine — a critical step toward initiating formal offtake discussions. Management framed the development as the final step before commercial engagement, with commissioning expected to provide the quality validation necessary for securing customer agreements. LibertyStream has been on zero promotion mode for several months while they prove out their tech, a period that saw them ditch the word ‘lithium’ from their name to focus more on the fact that they’re processing brine rather than exploring for it.

Magma Silver Corp. (MGMA.V) — Magma Silver has launched a field program at its advanced-stage Ninobamba silver-gold project in Peru, designed to refine targets ahead of a planned fourth-quarter drill campaign. The work will concentrate on the Jorimina and Randypata areas, where the team aims to optimize drill orientation and identify new site locations. The stock flaked recently after early paper went free trading and promo announcements came to not a lot of actual promo, shaving 50% off its share price. It has begun a slow climb over the last few days now that the dust has settled but remains a ticker that will be reliant on marketing til those Q4 numbers land. Head on a swivel.

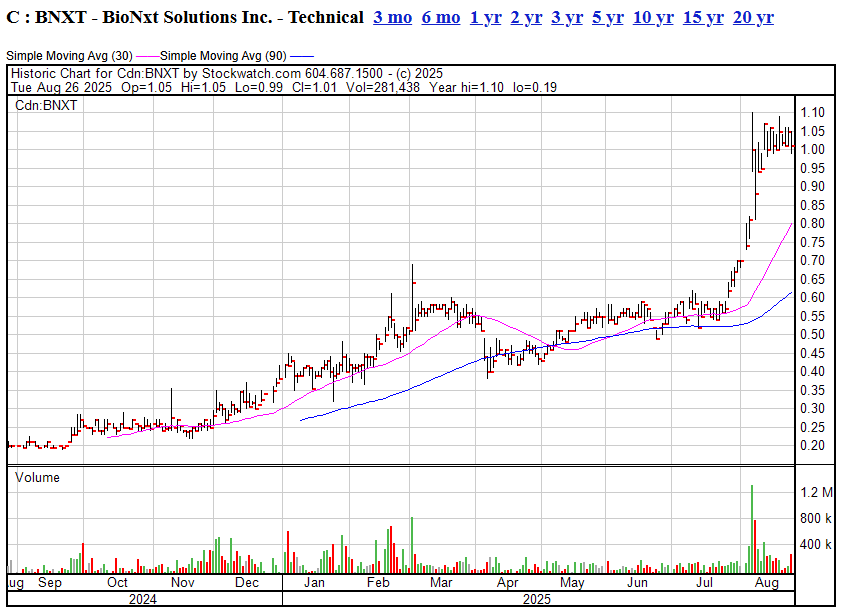

Bionxt Solutions (BNXT.C) has hired ‘ze Germans’ to get IR word out until later in the year. Mario Hose and Yves Toelderer will be the euro team involved and, at 80k euros per month, there’ll be an expectation of upward mobility. Bionxt is a bioscience company developing next-generation drug delivery and diagnostic technologies, with proprietary platforms that include sublingual films, transdermal patches, oral tablets, and a targeted chemotherapy system aimed at reducing cancer treatment side effects. It’s had a solid stock run over the last month, doubling its share price as it fast tracks its multiple schlerosis drug IP patents.

Argo Graphene Solutions Corp. (CSE: ARGO) — Argo has entered a working relationship with Ceylon Graphene Technologies, a top producer of high-grade graphene oxide, in which Ceylon will supply graphene oxide paste (≥20% purity), with Argo committed to scale from 1,000 kg up to 4,000 kg over the term, to be processed into dispersions for use in concrete, cement, and asphalt. The partnership includes data sharing, co-development of advanced additives, and a royalty provision for new customers introduced by Argo. With an initial two-year term and extension options, the agreement sets the stage for potential joint manufacturing as Argo builds out its North American distribution and eyes global expansion. With Hydrograph Clean Power (CSE.HG) investors scrambling after it experienced a multi-day stock price wipe out, Argo may actually be closer to graphene commerciability than HG, but at a $15m market cap, rather than HG’s $480m. Perhaps worth a look.

Nordique Resources Inc. (NORD.C) — Nordique has begun its 2025 base-of-till drill program at the Isoneva gold project in central Finland, marking the company’s first drilling since optioning the property in June. The program calls for roughly 500 shallow BOT holes across high-priority areas including Korpisalo, Ahveroinen, and Tiaskuru, where strong gold-in-till anomalies, high-grade boulders, and geophysical data suggest significant potential. Management emphasized the milestone as a foundation for steady news flow and discovery-driven value in an underexplored Finnish gold district. They also emphasized to me, that former shell CEO Balbir Johal is in no way connected to the company. This is good because that dude bullshitted a lot of people, myself included, into sinking cash into this company under its previous name, then took off, claiming he’d had a jammer and letting the whole thing crash. New management have a new business plan, new projects, and a new clean way of doing things.

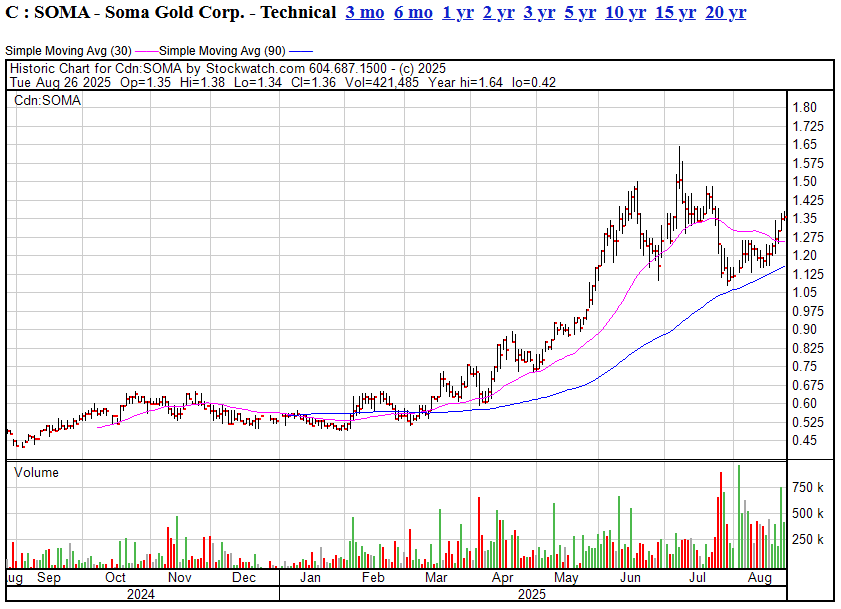

Soma Gold Corp. (TSXV: SOMA) — Soma has closed the second and final tranche of its non-brokered private placement, issuing 1.51 million units at $1.15 for gross proceeds of $1.73 million. Combined with the first tranche, the company raised $17.25 million through the sale of nearly 15 million units. Proceeds will fund mill expansion, ore sorting infrastructure, accelerated exploration and development at the Nechi mine, and working capital. Management highlighted strong investor demand and strategic participation as validation of Soma’s growth trajectory, but my interest comes from the solid insider involvement. Share price holding up well, despite the big raise.

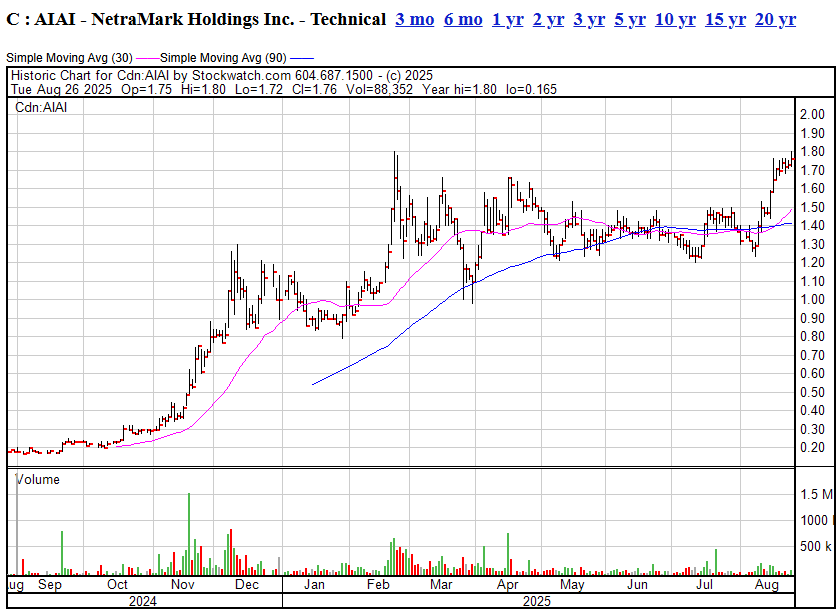

NetraMark Holdings (AIAI.C) – NetraMark continues to roll upward this week, on the back of increasing interest in its AI platform for helping clinical trials operators weed out bad patient data. There’s no news, but the deal looks good and partnerships are growing.

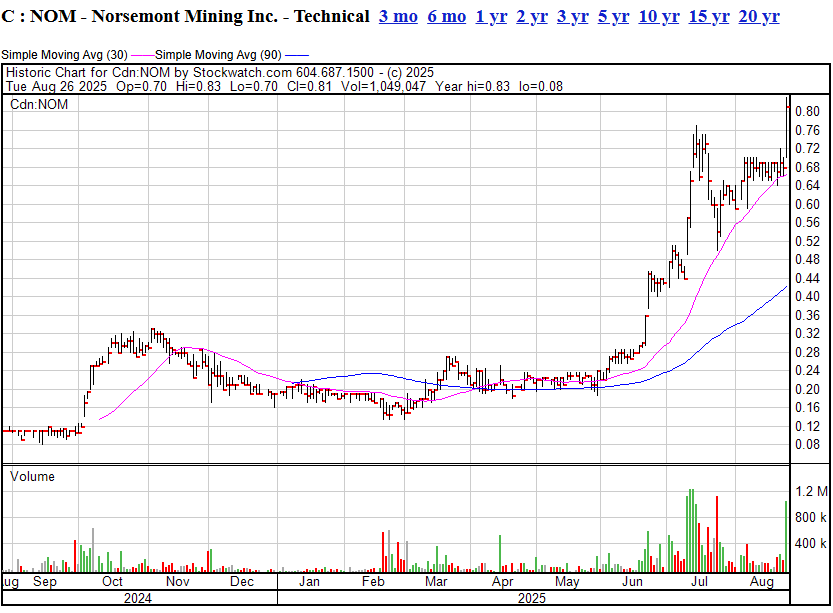

Norsemont Mining Inc. (CSE: NOM) — Norsemont has closed the second tranche of its non-brokered private placement, raising $1.39 million through the issuance of 2.32 million units at $0.60 each, and a third tranche at $1.19m. Legendary mining investor Rob McEwen, chairman and chief owner of McEwen Inc., led the 2nd round of financing, becoming a strategic shareholder. Management framed McEwen’s support as a strong endorsement of the company’s vision and a catalyst for advancing the flagship Choquelimpie gold-silver-copper project in Chile, a previously permitted mine with 2.18 million indicated and 0.56 million inferred gold equivalent ounces, extensive drilling history, and significant infrastructure in place. The stock has been turbocharged for a while now and continues to nom nom nom.

— Chris Parry

FULL DISCLOSURE: Not client companies and no commercial connection, though we may buy and sell the stocks mentioned.