Back almost a year back, I told readers about a then-private company looiking to go public that I thought was a banger in the making.

Saga Metals (SAGA.V) had three prongs as a resource explorer, each with value by themselves but a nice combo when put together.

One prong was their uranium project, being pushed forward by none other than Rio Tinto.

Another was a lithium deal which, while not a sector that has been drawing great interest lately, could be interesting out in Quebec as a province that loves folks digging into it.

And the third was a titanium/vanadium/iron project, again out in the Maritimes, and with the potential to catch folks by surprise.

I stopped talking about the deal after it went public due to, among other things, a feeling the company thought raw technicals would be enough to propel the stock.

Maybe it’s my marketing background, but I think every public company has a duty to present itself to investors outside its comfort zone, and though the regulators look upon that as in herently seedy and make life hard for those in the business of talking about explorer stocks, there are simply too many bodies out there looking for attention at the same time, and not enough old school resource investors perusing through drill reports to be able to just sit quietly and expect good things to happen.

Saga sat quietly, despite decent news, plenty of work, partners of heft, and involvement in sectores that aren’t terrible.

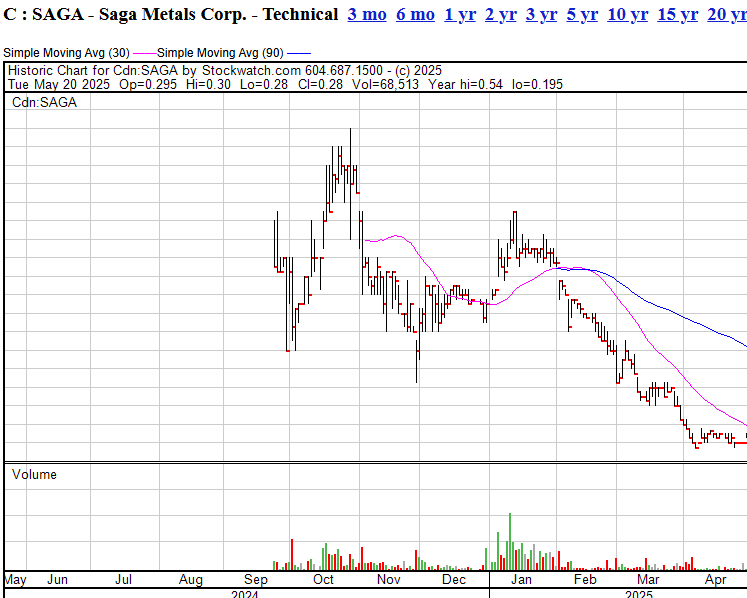

And for a hot minute, it didn’t matter. The stock ran from $0.40 to $0.52 over its first month.. and then it didn’t.

Trading volume and the stock price rose on the back of an expensive one month marketing program talking about drilling work that had just begun… but the thing with drilling is, there’s a timeline gap between when you start the drilling and when you get results back, which can run for months.

Months during which folks see other shiny things and shift their attention.

Months where folks see a slide in value and don’t know what the plan is to get it back.

Months during which the aforementioned marketing push… ends.

Months during which one guy selling their stock leads to another guy selling, which leads to another guy selling their stock..

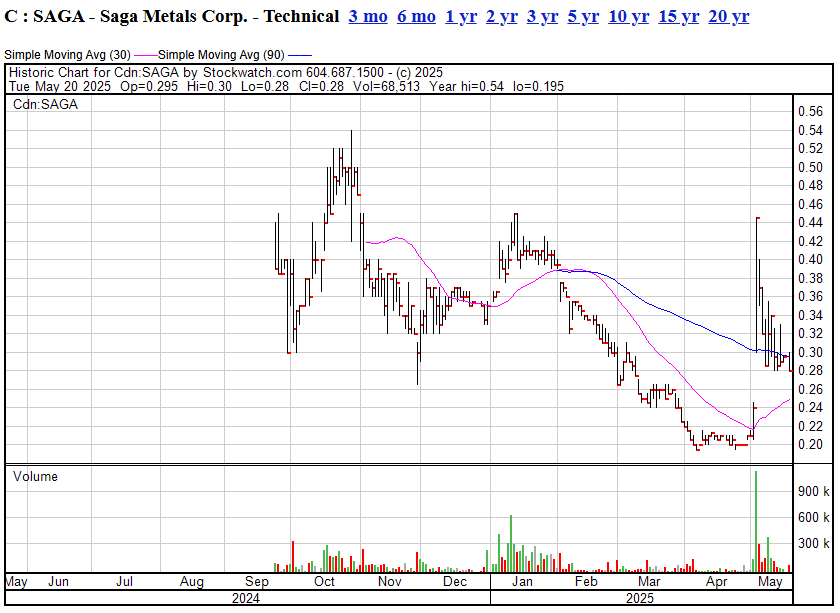

When the drill results came in for the Radar titanium/vanadium/iron project – the less hyped of the three projects they roll with – and a new marketing deal kicked in, the share price ran again, all the way from $0.20 to $0.45, a veritable smash hit!

But without a shareholder base of folks with a long term outlook, the bagholders sold into the results, forming a new base at $0.28 – higher than the recent low, but far below the public markets entry level, when the company was far less advanced.

Currently, the Saga company market cap sits at $9.4 million, whch I honestly think is a bargain for buyers but, without new buyers coming in on the regular – without marketing of the story and education aimed at the casual investor – she waits.

And there’s nothing worse, for a shareholder who may be underwater, than waiting during an information vacuum.

I like Saga. I think it’s an interesting story or three, but until someone tells it to the world on a consistent basis, rather than in the form of smash and grabs, it’s going to continue fighting the tide.

— Chris Parry

FULL DISCLOSURE: Not a client, but you probably figured that out.