We’ve been talking about Saga Metals (SAGA.V) since before it was a public company and it has deserved everyt rose we tossed its way.

We’ve been talking about Saga Metals (SAGA.V) since before it was a public company and it has deserved everyt rose we tossed its way.

Your standard junior mining explorer has one property it hopes to stick a hole in one day, maybe another in the bottom drawer that it’s already tried and failed on that nobody wants to take off their hands, a five-digit bank balance with a six-figure CEO, and an all-in hope that whatever sector it finds itself in is the same one people happen to be sweet on right now.

They go to market with a solitary plan that comes to “raise a little money and hope everything works out.”

Rarely does everything work out.

Most of those happy little triers spend their first three years working up to the hope that a big player takes a look at them and says, “we’ll take it from here,” and should that ever happen, they’d consider it a job well done and time (and money) well spent.

Cool. So what do you call a mining explorer that comes to market WITH a giant partner who has aleady looked them over and said, “we’re in,” AND a primary property in another sector that it looks like the whole industry overlooked, AND a slim executive team putting it all in the ground AND a third property with good potential in two other sectors AND a fourth property in another, with all of those properties having cross-over appeal… uranium and lithium and titanium and vanadium and iron.. oh my!

And what if all of that came with money being added to the bank balance by the big partner, that allows the management team to do more exploring without diluting?

And what if all of that came with NO shell company baggage and super cheap paper to worry about, because they went through an IPO instead of an RTO, complete with the extra auditing and paperwork and oversight that comes with that?

What if they just set things up RIGHT, so that everyone could make money along the way, without crippling the company with sneaky dealings and self interest and hit-and-hope plans?

The answer to those questions is, it would look like Saga Metals.

They did it right. They kept it clean. They aimed wide and did the work and debuted like a junior miner that’s been around five years, rather than a Howe Street pump.

And what happened four days into a nice clean debut?

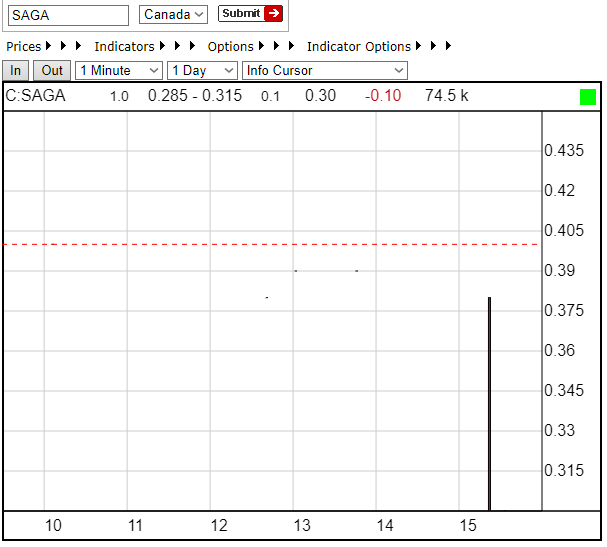

Some asshole sold a fat swathe in the last hour of the trading day and took 25% off the share price.

You shitbag.

Hey man, there are days when we all have to interrupt our long held plans for profitability to get some cash out quick, but the way to do that isn’t to just crush the share price in one fell swoop. Maybe you call the company and ask them to find someone to cross you out. Maybe you sell a little per day over a few days and let it heal. Maybe you let the CEO know you need to make a move, so they can try to work something out.

But you don’t just blast it out in one trade and eat up the entire bid at the end of the day. That’s rookie stuff. The weakest of weak hands. Selfish and stupid.

In short, someone who’d likely bought in on Saga at the private financing stage just got impatient/greedy/selfish and whacked the legs out form under it.

But here’s the thing with weak hands – if they have to extract their cash so they can cover the cost of their girlfriend’s diamond bracelet and their wife’s forgiveness ring, that might leave an opportunity for you to swoop in and eat their cheap sell-off.

At the current share price, SAGA has an $8 million market cap, and that’s insanely cheap.

The market had been happy with it at $10-12 million since it debuted, which I’d still argue is cheap, but at $8 million, that’s a crazy deal.

- I could see not buying in over the first few days it was public, while you’re watching to see where things would settle. I do that.

- And I could see not buying because you like to get in on dips and there hadn’t been one yet. I do that too.

- And I could see thinking, let’s see what the newsflow looks like early. All of these things are valid.

But now you get the stock for a 20% discount, and that’s interesting.

SAGA owns a hatful of properties on the east coast, including a fat uranium plot, a lithium project that Ri0 Tinto (RIO.NYSE) has bought into and is working right now, and accompanying vanadium, titanium, and iron projects in the Maritimes that all contribute to the same need for battery metals.

They management team have played a straight bat on the deal since long before it came public, they passed Rio Tinto’s bullshit detectors without a problem, and if something is going to kick out one of its legs, better it be an early financing rube getting the vapours than the usual shell company bullshit that has harpooned so many a deal before it.

There’s a long way to go on this play, and the team are charging into the breach at full speed.

Take advantage of the stupid..

If you want even more depth, here is the latest interview with Saga CEO, Michael Stier.

— Chris Parry

FULL DISCLOSURE: Saga Metals is an Equity.Guru marketing client