Troubadour Resources (TR.V), a Canadian junior operating in British Columbia and Quebec, put some serious cash in the till when the company announced on September 12, 2024 that is had closed its recently announced non-brokered private placement raising $4.455 million CAD during the quarter.

Troubadour remade its leadership at the beginning of the year, naming Chris Huggins as CEO and Navin Kumar Varshney as chairman of the board. The renewed management team rebranded the company as a gold and copper focused mineral explorer with its flagship Senneville Project located in the storied Val d’Or mining camp.

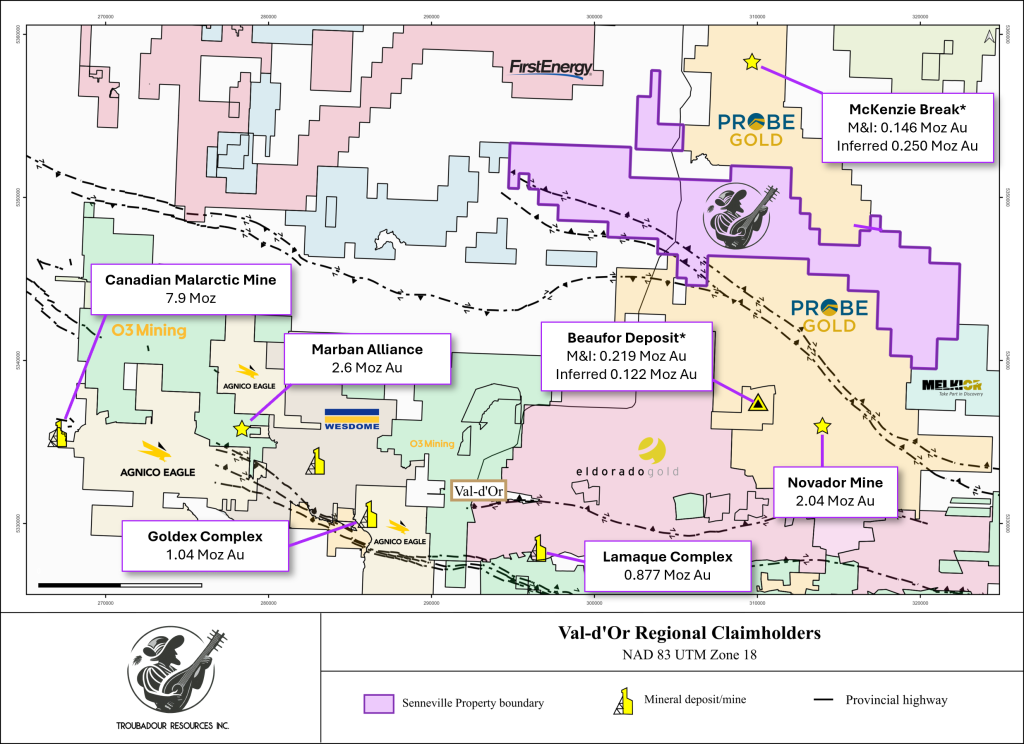

Senneville, situated just 25 kilometres northeast of the fabled gold mining centre of Val d’Ore, Quebec, is comprised of 173 mineral claims spanning more than 100 square kilometres. The project has some amazing closeology as it is contiguous with Probe Metals’ Novador Project which hosts the 2.04-million-ounce Monique gold deposit. North of Senneville lies Monarch Mining’s Beaufer mine which has produced over 1.1 Moz gold.

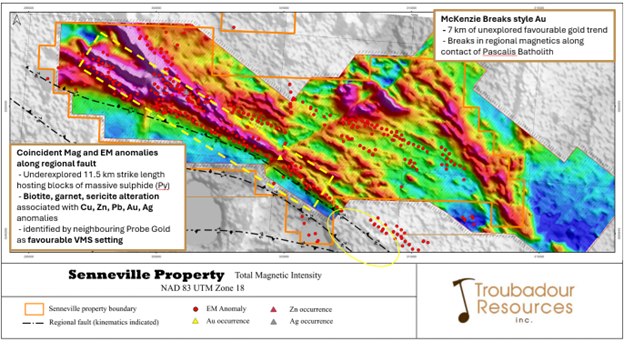

Now that Troubadour has completed its option payments for Senneville, the money raised will completely cover it’s planned six-month maiden exploration program over a 11.5-kilometre VMS target at Senneville that will earn Troubadour 100% interest in the project.

“I am excited for this year as our company is financially strong and has great assets, particularly with us securing the prospective Senneville Copper-Gold VMS Project. With $4.455M raised since the acquisition of our new flagship project, we are excited to embark on aggressive program for the rest of 2024 as we work to secure 100% of this world-class project located in the heart of the prolific Val d’Or Mining Camp. The metals business looks promising, especially with potential supply shortages, highlighting the importance of our projects in Quebec’s globally recognized mineral-rich greenstone belt. We look forward to sharing further updates in the coming weeks and months as we work towards making Quebec’s next major copper discovery.” – Chris Huggins, Troubadour CEO

Troubadour worked a deal on September 10, 2024 to acquire all the issued and outstanding shares in Greenflame Metals, effectively grabbing 100% interest in and to 76 mineral claims covering 4,161 hectares contiguous to the Senneville Project, significantly expanding Senneville exploration potential.

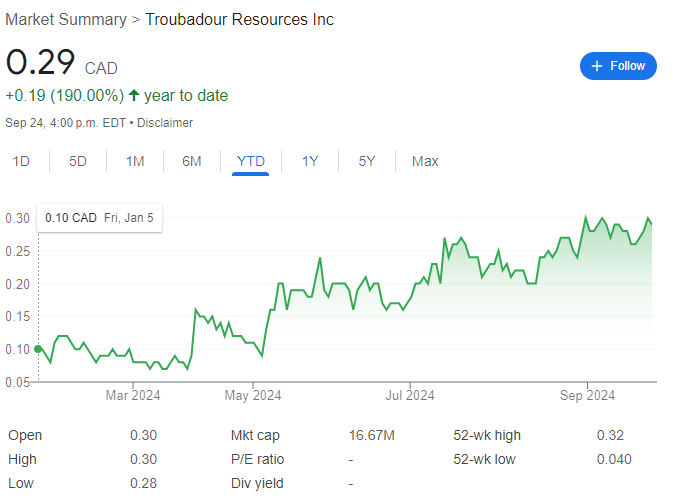

Troubadour has been all about value enhancement since it handed the keys over to Huggins and Varshney and the market has taken notice. In the last twelve months, the junior explorer has climbed the boards with share prices rocketing 190% to $0.29 per share CAD.

“I am thrilled with the transformation of Troubadour under Chris’s direction. Chris has built a new technical team, new shareholder base, and really energized the Company since he has taken over, growing our market cap by over four times since his appointment as CEO. Armed with a strong treasury, I look forward to helping him develop our asset in the renowned Abitibi Greenstone Belt as he works to deliver the next generation of gold and copper assets in Quebec. Chris’s leadership has positioned the company to carry out its exploration plan in 2024 confidently. It is early days, but I believe the growth potential here is exceptional. I am very excited to support a mining entrepreneur of Chris’s calibre as he builds Troubadour into the next major Canadian metals exploration company.” – Navin Kumar Varshney – Chairman of the Board of Directors

Speaking of market cap, Troubadour’s $16.67 million enterprise value is deliciously economical as the company still has a fairly tight share count of 57,920,894 issued and outstanding, and fully diluted the count only jumps 72,477,397. This means that good news following the upcoming program at Senneville could power another considerable share price rise. Never mind the fact that Troubadour is also sitting on two other properties in British Columbia that show the potential for even more value enhancement.

Full speed ahead seems to be Troubadour’s motto and that couldn’t bode better for shareholders as the junior with a mission continues to actively expand its value proposition in key domestic mining districts with a history for prolific and lucrative mineral discoveries. Do yourself a favor and check Equity Guru founder, Chris Parry’s detailed analysis of Troubadour. Remember as always to do your due diligence and speak with an investment professional before making any portfolio decisions.

FULL DISCLOSURE: Not a client, though an investor with the company requested we look at it, and we agree it’s worth talking about. We’re buying on the open market. Consider us conflicted if you like.