Regular readers know all about the Plurilock (PLUR.V) story, but for the uninitiated, here’s the short version:

- Canadian infosec tech company with AI-based ‘continual ID check’ IP, dozens of big US and Canadian clients bringing in $70m+ in annual revs

- Long undervalued due to low margins and weird local aversion to tech deals on the public markets, left with $10 million market cap

- Low cash position had meant ongoing raises while trying to right-side financials, adding to the stigma

- New crew rolls in at the low, cleans up debt, takes a big position through cheap financing, starts buying on the open market

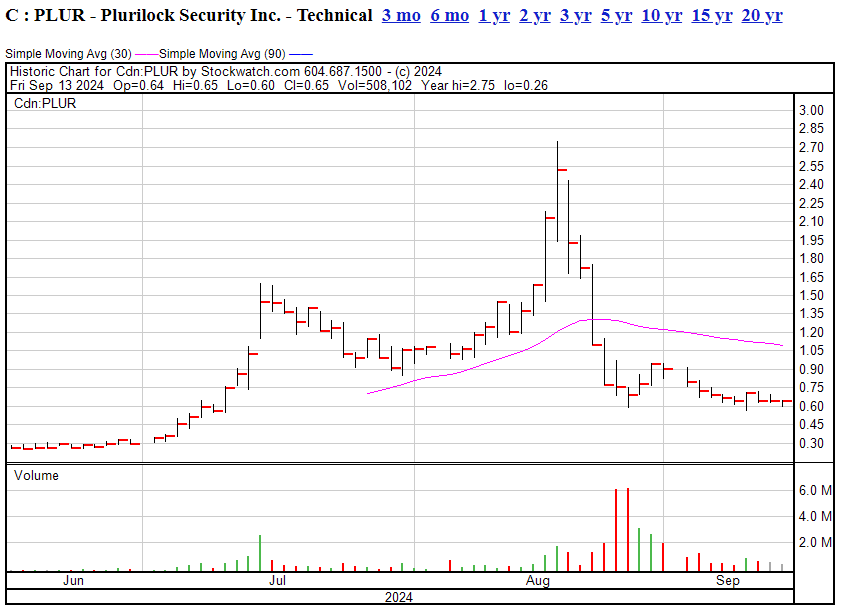

- Stock price runs from $0.20 to $2.40 over a few weeks, is attacked by shorters, drags back to a buck despite consistent insider buying, settles in at $0.70 range

- Warrant executions bring millions in cash into the company as insiders keep the share price propped at a $35 million market cap, up 2.5x from the low

- Dust settles

And that’s where we are.

Now, the cynics among us will say “well that’s a pump and dump, bruh” and I can’t tell you you’re wrong.

I can tell you that I *think* you’re wrong, because of a few points noticed along the way.

- The big drop came before the earlier fat financing paper became free trading. Sure, there are ways to wriggle out of your position early if you’re rich enough, but as the stock was coming down, it wasn’t selling into the void.. a concerted effort was being made to buy everything being sold, while the seller was offloading hardest in the first and last ten minutes of every trading day, which is what you don’t do when you’re easing out of a position, but rather when you’re trying to scare others out of theirs. In other words, the pattern indicated a short attack, not an insider sell off, and the buying indicated an ongoing effort to staunch it, not a smatter of little retail guys getting suckered in.

- After the financing unlock and quarterly financials, when naysayers predicted the company would be terrorized by sellers, the stock held. There was no frantic sell-off, in fact the buying continued – if you want to hand over your stock for $0.62 next Moonday, they’ll take it all day.

- The company dropped serious news AFTER the financing unlock, when the stock had leveled off – not as hype fuel during the rise or a ‘don’t sell’ push as it fell.

- The news itself was transformative, if you look at it in a holistic way.

Let’s go through four news releases in detail and then I’ll tell you and I think you’ll see a clear idea of what’s going to happen next on this stock.

THE STEP UP

Plurilock Security Inc. has engaged Clear Street as its financial adviser to assist the board and management in refining United States strategic options.

Plurilock generated $70.4-million in revenue for the year ending Dec. 31, 2023. These revenues come from an integrated cybersecurity company platform that includes hardware and software sales, managed critical services, and the Plurilock AI (artificial intelligence) SaaS (software as a service) platform. Eighty-nine per cent of Plurilock’s business is conducted in the U.S., with the U.S. federal government representing the company’s largest customer. The ecosystem of U.S. government customers and partners is the foundation of Plurilock’s business, as the company is intertwined with agencies across homeland security and defence, energy and agriculture, transportation and commerce, health and human services, and justice, among others.

Plurilock has recently added prominent Americans to the company’s industry advisory council, including former CrowdStrike board member/AppDynamics president Joe Sexton and former White House lawyer/senior CIA officer Bryan Cunningham. This builds on Plurilock’s American leadership, which also includes company board members Jennifer Swindell who was formerly senior vice-president of Booz Allen Hamilton and a special operations officer in the U.S. Navy; and Ed Hammersla who was formerly head of Raytheon Cyber Products and chief strategy officer of Forcepoint.

TRANSLATED: Plurilock has loaded its board, management team, and advisory board with big fish in the US governmen, military, and corporate security services industries, the sort of people who get you into any boardroom and can vouch for you with the biggest buyers. And Clear Street has been brought in to open the doors to the biggest of fat financiers should you decide to either go acquire some marklet share by buying a competitor – or be acquired… or have your IP acquired.

Next.

THE LOAD UP

PRELIMINARY SHORT FORM BASE SHELF PROSPECTUS

This preliminary short form base shelf prospectus relates to the offering for sale of common shares, warrants and subscription receipts, debt securities or any combination of such securities by Plurilock Security Inc. from time to time, during the 25-month period that the Prospectus, including any amendments hereto, remains effective, in one or more series or issuances, with a total offering price of the Securities in the aggregate, of up to $200,000,000.

TRANSLATED: Plurilock is setting up the ability to, at any time, issue up to $200 million in stock to further a financing or acquisition. The naysayers looked at this and thought ‘they’re going to dilute the stock 10x!’ while the rest of us saw the words “up to” and recognized that figure could be $0 just as easily as $200m. The company has laid out the mechanism through which it can buy something worth $200m with $200m in stock and turn itself into a public markets Incredible Hulk, but could also sling $10m in stock at something smaller than can help on revs or margins or government penetration 0r IP. When you consider Clear Street is actively looking for potential acquisition targets/acquirers, prepping in this way this makes obvious sense.

Next.

THE TEAM UP

Plurilock Security Inc. has formed a partnership with TD Synnex, a leading global distributor and solutions aggregator for the IT (information technology) ecosystem, to provide artificial intelligence services in North America.

Under the terms of the partnership, Plurilock will provide AI-focused (artificial intelligence) critical services and cybersecurity solutions for TD Synnex across their North American operations. The services and solutions provided may include, but are not limited to: security operations; offensive security and penetration testing; data and intellectual property protection and loss prevention; zero-trust architecture and implementation; digital and AI transformation; and related advisory and governance, risk and compliance (GRC) services. This represents the initial phase of a potential wider partnership, with the possibility of future expansion into the company’s global footprint.

And:

PLURILOCK ANNOUNCES PLURILOCK AI INTEGRATION WITH ACRONIS CYBER PROTECT CLOUD PLATFORM

Plurilock Security Inc. has completed an integration between its flagship Plurilock AI (artificial intelligence) cybersecurity platform and the Acronis Cyber Protect cloud platform, which protects hundreds of thousands of businesses around the world.

The integration enables managed service providers (MSPs) that secure their customers through Acronis to easily leverage Plurilock AI and its cloud access security broker (CASB) and data loss prevention (DLP) capabilities. They can now do this natively, through the same Acronis dashboard that they already use to manage customer environments and security.

TRANSLATED: Plurilock is executing agreements to wire itself into the products and services of two massive IT services companies with customer roster that FAR outweigh their own, building into their systems in ways that allow PLUR to take a small cut of their sales with higher margin and less handholding. When Acronis sells a solution to one of its 500,000 client companies and Plurilock’s systems are right there as an upsell, to be turned on at will. When TD Synnex, with its 240,000 employees, reaches out to its customer base and says, “who wants AI tools” and sends Plurilock’s services out to anyone that says “me.” These aren’t ‘sales agreements’ where you hope their sales force will bother selling clients something off-book that they make a little commission on.. they’ve clearly become a part of both companys’ services.

BTW, if you’re wondering how big Acronis is, here they are in the background of this weekend’s Premier League game between Manchester United and Southampton.

THE WRAP UP

You don’t need to be in the boardroom to see what’s happening here.

Plurilock just got far bigger, without having to build out a sales force and spend months and years proving its reliable enough to be added to a multitude of government, military, and Fortune 500 buying networks. Revenues will inevitably rise, but costs really won’t.

Meanwhile, Clear Street is out there looking for fat deals that PLUR can either buy (using that shelf prospectus), or be bought by, presumably at a premium WAY beyond today’s $30m market cap.

And with all of that happening, the daily share price becomes moot. They’ve stopped running the board, spending millions buying on the open market, and fighting off shorters to make sure you’ll notice them. The share price is $0.65. That’s clearly where it’s going to sit for a while.

If it goes down during the day, they’ll bring it back at the end – like they did today, and like they did on Wednesday.

If you want out at $0.65, go for it. They’ll oblige.

But clearly they’re not going to run it up to a buck again for you… you had your chance on that. and if you didn’t sell when it was over $2, that’s on you.

But that doesn’t mean you have to sell today. If you remain a holder, like I am, the move here is to do precisely fuck all. Sit tight. Wait and watch.

Because Clear Street doesn’t get out of bed for 8-figure deals, and TD Synnex and Acronis don’t let two-bit pump and dumps into their client networks.

Plurilock’s next move is a massive monetizable event, and they’re openly calling their shot, if you’re listening.

Oh – and if you still think this is a pump and dump, it remains up 3x from that financing.

— Chris Parry

FULL DISCLOSURE: Not a client, no commercial relationship, just buying the shit out of it whenever gomers want to sell cheaply. Consider me conflicted, I’m good with that.