Government work is a cyclical business, and it turns out one financial quarter isn’t always like the next.

So when, late last week, I told you this, I was, well, wrong.

Here’s what we do know: Plurilock earns a decent CAD $43.6 million a year in revenue based on the last quarter financials, which doesn’t include the US $6.9 million in new contracts that just landed.

And the market cap of the company is just CAD $20 million.

Yep, Plurilock is trading at less than half their annual earnings.

Yeah, I was wrong twice actually.

Based on FY2023 revenues, Plurilock actually does CAD $70.3 million, because some of their work is seasonal, which means their market cap was almost a quarter of annual earnings.

If you’ll excuse my use of the parlance of the times, holy shitballs.

From the earlier piece:

An AI-driven information security company with a patented technology that watches user interactions for signs that a computer user may not be who they say they are, the pitch to potential clients is simple: relying on a start-of-the-day passworded login isn’t enough in the modern day of IT. Instead, Plurilock constantly checks to make sure ‘Bob hasn’t hit the restroom and left his terminal open.’ It checks typing styles, tabs open, how the mouse is used, etc etc, looking for errant use. This equals CONSTANT background ID checking, instead of one-and-done ID checking that bugs the user.

That’s what they do, but who they do it for is all important, and that information is unfortunately a locked box.

That inability to just say out loud who they’re doing multi-million-dollar deals with has been an anchor around their neck.

Also, traditionally, their low share price made it hard to bring in financing to help properly execute and tell their story.

But their client list, if one reads between the lines, is BANANAS.

- Take today’s news:

Plurilock Security Inc. has expanded an existing professional services engagement with a publicly traded semiconductor company on both the S&P 500 and Nasdaq 100 indexes.

Now, I could hazard a guess who that company is, and maybe I’d be right, but if I *knew* what the company was, I suspect we’d be fighting each other with axes to get at the stock.

Plurilock Security Inc. has been awarded a contract to deliver cloud and data security solutions to a major global laboratory data and advisory firm through its Aurora subsidiary.

Who the hell is that? NO IDEA, but it sounds big.

Plurilock Security Inc. has signed a $6.16-million (U.S.), five-year contract with the United States Department of the Treasury.

Well, we sure as heck know who that is, and being able to do info security work with the US Department of the Treasury tells you those other deals weren’t with Uncle Fappy’s Dollar Bodega.

Let’s be clear, you don’t get to rock up to the US Department of the Treasury and get a sales lunch booked for next Wednesday. They’re not answering the phone to sales calls. You’ve got to be part of the accepted and approved machine just to get through to voicemail.

They need to go through your trash and talk to your sister about that time you did that thing with the thing and had to change schools. They’re going through your background, and your sales guy’s background, and his wife’s background, because Plulock is selling systems security to the biggest companies and government agencies around and if they screw up, or get sneaky, devastating bad things can happen.

Like today, when Ticketmaster got hacked and had to send almost everyone in the world an email admitting their data might have been lost. We’re lining up the lawyers on that one.

“Sales call from Ticketmaster on line two!”

What Plurilock does is worth far more than Plurilock is charging, but that’s how you establish trust and market share and the ability to roll those contracts over every year.

So how do you get into this rarified air and do business with these organizations? How do you penetrate their server room and get the okay to plug into their network?

You either drop your pants for four years and show them everything, or you buy your way in.

Plurilock bought their way in. They acquired market share. They picked up permission and respect by taking over other companies that had done that work over years and, in doing so, they spent a bunch of cash that they struggled to replace because, markets.

What they needed from the outset, was friendly hands. Investors that want to build, not borrow. Investors, not traders.

And it appears, from what I can see, they’ve found them.

FOR REAL.

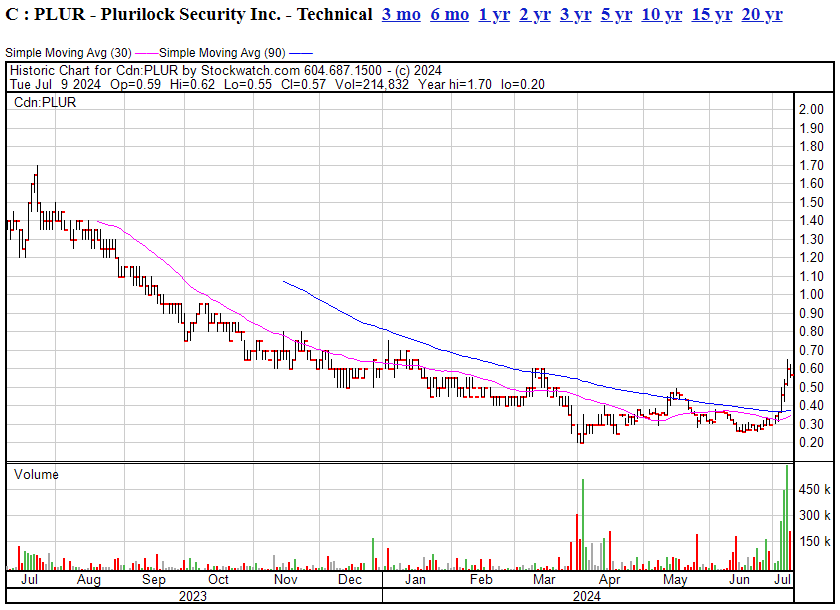

Look, I don’t know, it could all turn the other way in a week and folks who’ve doubled their money already could start piling out and we’ll be back to the usual junior markets jiggery-fuckery merry-go-round, but also maybe not. Today, after a week of doubling and smooth upward runs, the stock smoothed out. Lower volume, slight drop.

I’m cool with that. Because that’s ORDERLY.

The next several days are going to be super-important, because they’ll tell you whether this has legs, or the legs came and went.

Is it a pump or is it a re-valuation?

Are people finally hearing the story, or is that chart the story?

I’ll tell you now, as I have before, that I’m a buyer. I’ve believed in this company for a few years now and been DYING for it to get the credit it’s due.

I feel like this is that moment.

— Chris Parry

FULL DISCLOSURE: I bought stock. I own stock. I’m buying stock. They were a client a few years back Consider me conflicted all you like and do your own DD because come on, man. nothing’s perfect. Ever. Eyes open. Know what you’re getting into.