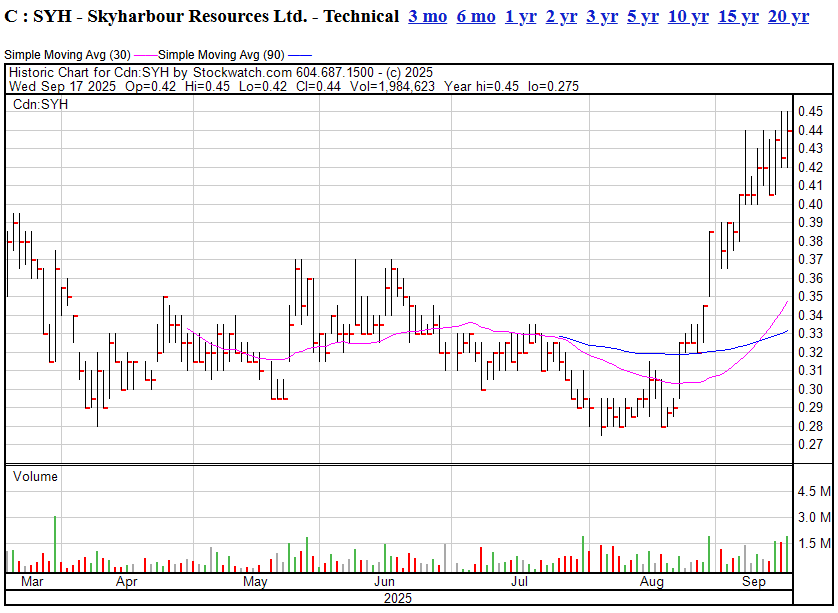

Long time readers know I’ve plenty of good things to say about junior mining mover/shaker Jordan Trimble. For a while, we repped his Skyharbour Resources (SYH.V), which duly climbed from the $0.25 range to $0.45 a few years back before we moved on to other things.

In the years since, despite building out its project and partner portfolio, the market didn’t reward the prospect generator model the company had executed, and it had slowly fallen backwards to that earlier starting point.

But today is a different day. Canadian leaders are making it clear that nuclear energy is in our future, and that locally sourced uranium will be central to that push, and suddenly folks are discovering Skyharbour once again as being the mid-cap explorer most likely to vault up a level.

In fact, without any news as a catalyst, SYH has re-rated by around 70% over the last month.

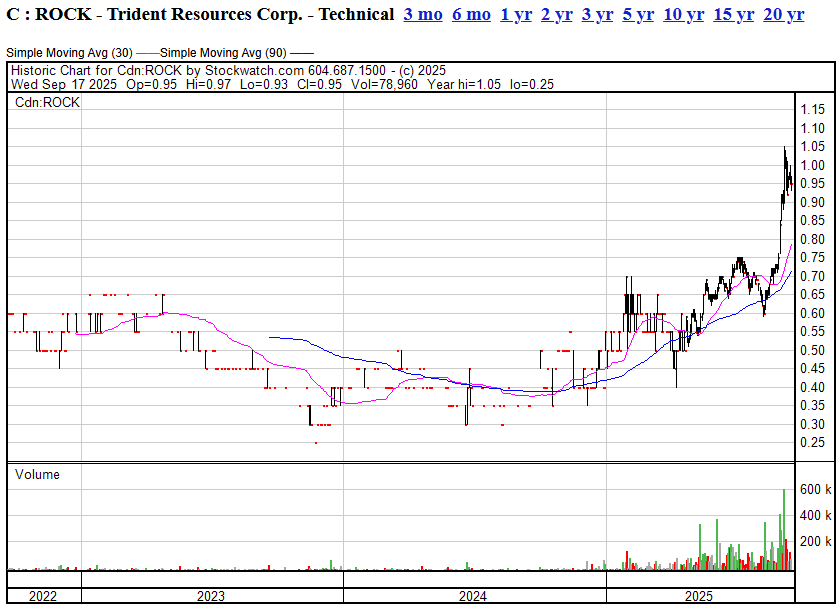

But while Skyharbour revs its engine, Trimble has a hand on the wheel of another vehicle in Trident Resources (ROCK.V) which is also hitting the gas right now.

If the ROCK ticker looks familiar, that’s because it’s a holdover from the old Rockridge Resources, which trudged along for years trying to catch a wave of enthusiasm in a rough resource space.

In October last year it found it’s reason for being, in a three way merger with Eros Resources and MAS Gold that, right now, has the attention of many in the market.

Both the Trimble companies are small-cap explorers riding some serious macro tailwinds (uranium and gold/copper, respectively), both are seeing strong retail chatter, and both are leaning hard into narratives that get people buying stocks first and asking questions later.

Let’s dig in.

Skyharbour Resources (Uranium in Saskatchewan)

The Flagship

Skyharbour’s flagship is its Moore Uranium Project in the eastern Athabasca Basin, Saskatchewan. If you know uranium, you know the Athabasca Basin is the Saudi Arabia of U3O8, with 10x the average grades found anywhere else. Moore has already coughed up high-grade intercepts (6%+ U3O8 over meaningful widths), which is the kind of number that gets Cameco and Denison guys shifting in their chairs.

They’ve also got JV and earn-in deals on a portfolio of properties. In layman’s terms, other people spend money to advance the project, Skyharbour keeps a piece and gets oit back if the partner fades. It’s a smart model in that it wildly reduces burn and lets SYH spread their bets across a whole district that’s suddenly white-hot.

The prospect generator model lowers risk, in that you have a lot more best on the table, but it also reduces the payoff if one of those projects hits a rich vein. In roulette terms, most companies put their bet on a number, while Skyharbour puts a bet on ‘evens’.

Three Pros

-

Perfect Macro Tailwind: Uranium is in a supply squeeze. Japan is back online, the US is stockpiling, Kazakhstan production is shaky, and the green-energy crowd has finally admitted nuclear is a must-have. That’s fuel for every uranium stock, especially Canadian juniors, and especially when Canada is starting to make reactor plans.

-

Athabasca Credibility: Grade matters. This isn’t a Nevada or Wyoming low-grade ISR story, it’s basement-hosted high-grade stuff. Investors know Athabasca has a history of discoveries that turn into billion-dollar mines, and SYH has lots of land to poke holes into.

-

Partnership Model: Multiple JV/option deals mean Skyharbour gets news flow without footing every drill bill. That’s attractive in a market where financings can be dilutive.

One Thing They Need to Work On

Clarity of the story. Skyharbour has a basket of projects, but retail loves a single, tight narrative. Right now, it’s Moore + JVs + minority stakes everywhere. Great strategy long-term, but confusing for casual investors who just want “the next NexGen.” They need to push Moore as the discovery play and advance the story.

Why the Stock’s Blowing Up

Two reasons:

-

Macro: Uranium has gone from niche to mainstream. Spot is pushing $100/lb, the highest in over a decade, and everyone wants exposure to the space.

-

Micro: Skyharbour keeps pumping out JV deals and drill updates that suggest optionality. If just one of those partner programs hits a 20m at 10% U3O8, boom — the stock re-rates again. Investors are buying a lottery ticket with multiple draws.

Trident Resources (Gold & Copper in Saskatchewan)

The Flagship

Trident is newly formed, so much so that their website is hard to find (let’s help that process along). Their key asset? The Contact Lake Gold Project in the La Ronge Belt, Saskatchewan. This is a past-producing gold mine that shut down in the ‘90s when gold was $300/oz. Cameco’s internal reports suggest there’s still a lot of ounces left, and Trident is now funded to drill 5,000 metres and prove it to the people.

They also have the Knife Lake Copper Project — a VMS-style copper play with historical resources and high-grade intercepts (2%+ CuEq over wide intervals). Copper is the “electrification” metal du jour, so the dual gold/copper angle plays well right now.

But make no mistake: the near-term story is Contact Lake. Investors love a “restart story” with gold flirting with record highs, over “explorer stories” that will take ten years to pay off.

Three Pros

-

Land Package Scale: 128,807 hectares across the La Ronge Belt. That’s not just one deposit, it’s district-scale potential in a historically productive belt that’s been underexplored.

-

Gold + Copper Mix: Diversification matters. Gold is the safe-haven, copper is the growth/EV story. Having both lets Trident sell itself to two audiences at once, and ride wichever is hottest, hardest.

-

Management Firepower: This is not some promoter-run shell. They’ve got geos and finance pros with legit discovery and deal-making track records, with Ross McElroy (Fission, McArthur River) and Ron Netolitzky (Eskay Creek, Snip) tied in is a credibility boost. Instant boardroom cred.

One Thing They Need to Work On

Fresh resource updates. A lot of what they’re leaning on is “historical resource estimates” from early 2020s or Cameco reports from decades ago, which isn’t fluff, but investors want NI 43-101 compliant, current numbers they can model. Until then, it’s a lot of “trust us, there’s gold in them there hills” which, it would appear, there is.

Why the Stock’s Blowing Up

-

Macro: Gold near all-time highs thanks to inflation fears, central bank buying, and safe-haven demand. Copper getting a second wind from supply issues and EV hype. Perfect storm for a gold-copper explorer.

-

Micro: The merger created a “newco” story with a tight share structure (31M O/S), cash in the bank ($11M), and fresh drilling at a past producer. Retail sees that and thinks: “cheap entry, near-term catalysts, lots of blue sky.”

Macro Picture: Why Both Are Catching Fire

This is a commodities super-cycle moment. Uranium, gold, and copper are all surging, each for different reasons:

-

Uranium: global supply deficit, nuclear renaissance.

-

Gold: inflation, instability, and central banks loading up.

-

Copper: electrification demand colliding with supply bottlenecks.

Retail investors are piling into anything tied to these metals. Both Skyharbour and Trident benefit from being in Tier 1 jurisdictions (Saskatchewan, Athabasca/La Ronge belts). That matters — nobody wants to bet on Congo risk right now. Canada gives a premium.

Micro Picture: The Hooks

-

Skyharbour: The hook is “high-grade uranium in the world’s best district, with partners paying to explore our land.” The optionality play.

-

Trident: The hook is “a past-producing gold mine at $300/oz is back in play with gold at $2,400/oz.” The revival play.

Different styles, but both hit emotional notes investors love — “lottery ticket with multiple draws” vs. “easy math on ounces in the ground.”

My take:

Noting that these aren’t client companies and I have no horse in the race, both these stocks are hot because they’ve got wind at their backs, smart operators, and real potential. Skyharbour is surfing uranium mania, Trident is capitalizing on gold fever and the sexy merger-newco angle. But remember: these are still early-stage stories. Lots of sizzle, not a lot of steak yet.

If you’re betting here, you’re betting on narrative + near-term catalysts (drill results, JV updates, resource upgrades). For Skyharbour, the big payday is if Moore delivers a tier-one discovery hole. For Trident, it’s proving Contact Lake still has enough juice to justify a mine restart.

They’re blowing up now because retail sees the setup and near term potential, not because they’re producing cash flow. Don’t confuse stock momentum with business fundamentals — but also don’t underestimate the power of a narrative when the macro tailwinds are this strong.

Me likey.

— Chris Parry

FULL DISCLOSURE: No commercial interest.