A few months back we wrote a piece on a company purporting to make graphene from bio-waste. We dug in and found that, while early, the tech appeared real.

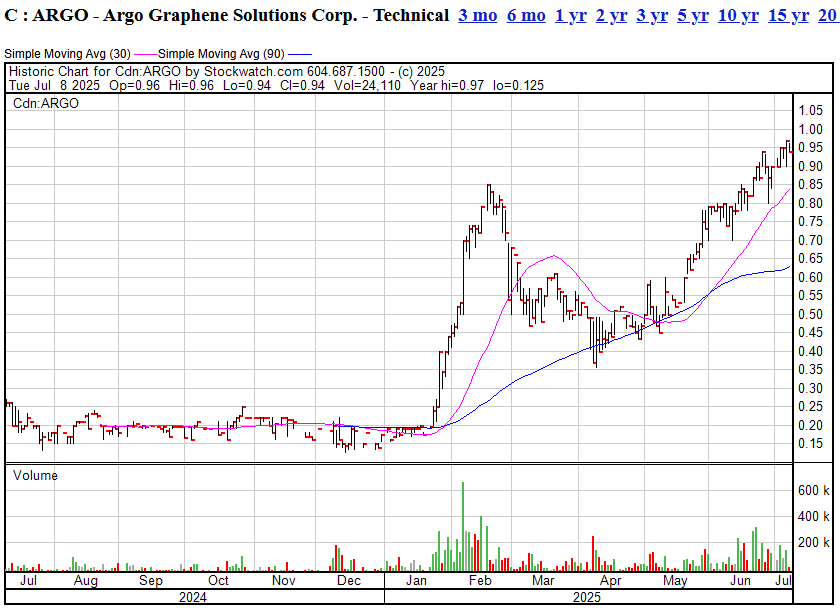

It wasn’t a client company, and we didn’t have a dog in the hunt, but it was interesting enough to plant a flag on it when the stock was at $0.20.

It had been thereabouts for most of the previous year, so I think our story brough a wave of investor sentiment considering it’s now at almost a dollar.

You’re welcome, readers.

Argo Graphene Solutions (CSE: ARGO – formerly Argo Living Soils) has taken a solid step from hype to application with news that it’s finalizing its first order of graphene oxide liquid—1,000 litres of the stuff—to develop concrete, cement, and asphalt products enhanced by this so-called wonder material.

Graphene has long held the promise of transforming everything from batteries to buildings, but Argo’s focus is narrower: improve the strength and durability of concrete while reducing its carbon footprint. The company’s additive is a graphene oxide (GO) suspension—essentially 4 grams of GO per litre of water—designed to mix directly into concrete batches to create lighter, stronger, more sustainable materials.

The supplier, an unnamed international firm producing graphene from high-purity (99%) vein graphite, is key here. Argo says this is one of the purest forms of natural graphite available and that the material is import-compliant under U.S. and Canadian regulations. They’ve also structured the deal with protections: the right to inspect shipments and reject any defective product, with replacements at the supplier’s expense.

What’s Actually in the Mix?

Let’s zoom in for a moment. Graphene oxide is a chemically modified form of graphene, which itself is a single-atom layer of carbon. While pristine graphene is difficult and expensive to produce at industrial scale, GO can be made from graphite via chemical oxidation—it’s more affordable and easier to mix into liquids like water or cement slurries.

Why bother? Because even in tiny amounts, GO can increase the compressive strength of concrete, improve flexural resistance, and reduce permeability—factors that could extend the lifespan of infrastructure like bridges and buildings, or reduce the volume of concrete needed for a given strength spec.

Concrete production is one of the largest industrial sources of carbon emissions. Cutting down the amount needed or extending how long it lasts has a direct environmental and economic payoff. That’s where Argo is aiming: high-performance, lower-footprint building materials that meet the growing ESG criteria being demanded by developers, municipalities, and regulators.

Is This a One-Off or a Scalable Model?

The order, while modest in volume (1,000L at 4g/L = 4kg of GO total), represents a starting point, not the finish line. Argo clearly views this as phase one of an integrated rollout, starting in North America and expanding into Europe pending regulatory certification. Its CEO Scott Smale says the aim is to deliver “salable” products right away while also positioning for growth in the EU.

But investors should watch closely: graphene is often more about promise than delivery. Technical barriers around uniform dispersion, cost, and real-world performance have derailed many graphene-based business models. If Argo’s mix design doesn’t deliver consistent gains in the field—or if the cost per cubic meter of GO-concrete isn’t competitive—contractors won’t bite.

That said, Argo’s previous work in carbon-rich biochar, and its stated interest in turning that biochar into graphene (per a January update on Equity.Guru), shows it’s not just a product re-seller. There’s a long-term ambition to vertically integrate—possibly even manufacture GO from its own feedstock down the line. That’s a smart move if they can control both quality and cost.

The Marketing Push Begins

The company has engaged two separate promotional partners to help spread the word. King Tide Media, out of Florida, has been hired for a one-month blitz with a $60K (USD) budget. That’s a sizable spend for a microcap company, which shows they’re trying to move the needle on visibility fast. Meanwhile, longtime IR firm MarketSmart is on board for another three-month engagement at $5,000 CAD per month.

Expect to see Argo’s name popping up more in financial and ESG circles over the summer. The company is clearly trying to elevate its profile just as concrete testing and prototype mixing begins.

Is the Market Ready for Graphene Concrete?

Graphene-enhanced concrete is not a pipe dream—but it is early. Large developers and municipal buyers aren’t known for rapid adoption. That said, the construction industry is under increasing pressure to reduce its carbon impact, and additives that can help meet those targets without overhauling equipment or methods are attractive.

If Argo can show that their GO additive works in the field—reliably, affordably, and scalably—they may find themselves on the radar of some larger industry players. Until then, the stock remains speculative but interesting, especially as a green infrastructure play in a market that’s slowly opening its wallet for those exact themes.

Graphene’s time might finally be coming. Argo wants to be at the front of that wave. Time (and test results) will tell.