Plurilock (PLUR.V) has been underrated by the market for way too long.

We’ve told you about it a few times, and each time we did, the stock moved a little until long underwater investors took the chance to churn out at a slightly higher than usual price, sending the stock back down and frustrating any new money that had come in.

An AI-driven information security company with a patented technology that watches user interactions for signs that a computer user may not be who they say they are, the pitch to potential clients is simple: relying on a start-of-the-day passworded login isn’t enough in the modern day of IT. Instead, Plurilock constantly checks to make sure ‘Bob hasn’t hit the restroom and left his terminal open.’ It checks typing styles, tabs open, how the mouse is used, etc etc, looking for errant use. This equals CONSTANT background ID checking, instead of one-and-done ID checking that bugs the user.

That’s what they do, but who they do it for is all important, and that information is unfortunately a locked box.

Here’s what we do know: Plurilock earns a decent CAD $43.6 million a year in revenue based on the last quarter financials, which doesn’t include the US $6.9 million in new contracts that just landed.

And the market cap of the company is just CAD $20 million.

Yep, Plurilock is trading at less than half their annual earnings.

What Plurilock does:

For military groups, government departments, financial institutions and more, constant ID verification is incredibly important, which is why Plurilock’s newsfeed is always a long line of ‘Plurilock announces new contract for $Xm‘ and ‘Plurilock renews US govt contract for $Xm.’

But Plurilock’s business model has one big problem, at least as it applies to retail investors, and that’s ‘if they told you who they were in business with, they’d be out of business tomorrow.’

When I get a new client, I can tell you who they are all day long, I can brag about it to the high heavens, but Plurilock deals in privacy and confidential data as they pertain to Fortune 500 companies, government departments, and the armed forces. None of those groups want their adversaries to know who’s running their infosec, so Plurilock can’t yell their names like a public company in a different field could.

They have to keep schtum.

For investors, knowing a contract exists isn’t nearly as big a deal than knowing it’s with a giant tech firm worth billions, or a major military organization with fat budgets.

Instead, Plurilock waves its hands and says, “Hey guys, we did.. uh, a deal.. with a group in government. You probably know them but, I don’t know, maybe guess who they are? It’s big. Leave it at that.”

And there lies the disconnect.

There are other companies in a similar position to Plurilock – yet they don’t trade at half annual earnings.

So why does PLUR find itself so cheap?

- Information security isn’t sexy to many retail investors, at least until some giant breach occurs and costs a global company hundreds of millions – then all of a sudden everyone’s looking for the next Palantir Tech (PLTR.NYSE).

- PLUR acquired too many assets, too quickly, in an effort to buy market share and US government and confidential organization trust a few years back. That put them on their heels financially for a few years, but it wasn’t all for nothing. It can take years to be approved to work with government agencies, but if you buy a company that’s already passed muster and has govt contracts, things move quickly. PLUR took that gamble and found an audience for its technology quickly.

- When your stock is down, it takes money to be able to promote yourself to the market and get it back up, but getting that money isn’t easy.. what do you do? Take expensive loans? Raise money at a low share price? Ultimately a company has to grin and bear, take what they can get, and just grab that bag, even if it hurts.

None of this was comfortable, but six months ago things began to changed.

In short, some guys with backing looked at what PLUR had tech-wise, what they were bringing revenue-wise, noticed that they were making a negligible loss largely due to having to maintain hard earlier financing decisions, and rode to the rescue.

The re-working of PLUR has been ongoing the last few months.

- They’ve streamlined costs.

- They’ve settled some debt with shares.

- They’ve rolled the stock back 10:1.

- They’ve renegotiated their financing and got better terms.

- They’ve been less afraid to remind people that their core product is an AI product, since that’s an industry retail investors are VERY much into.

How’s That Working Out For Them?

I mean.

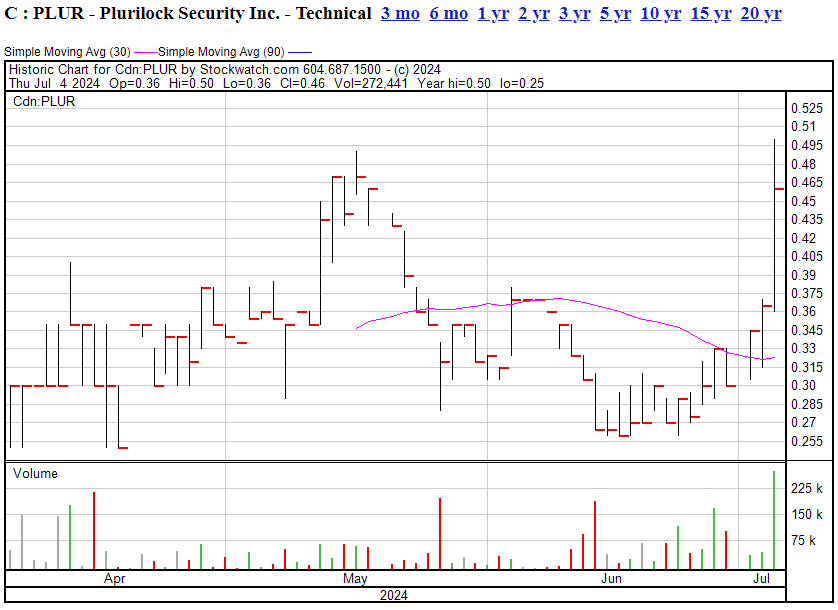

As of the last 48 hours, PLUR stock has begun to roll and, as I write this, today was the largest volume trading day of the last three months, and the second best this year.

On no news.

PLUR hasn’t been marketing itself yet, but you can see in the chart above that folks have been accruing stock hard since mid-June, and they appear to have busted through that waterline of long term holders looking to get out. If the company can continue with the activity of the last few days, with investors now knowing;

- hat the company is well-financed going forward

- That the company is rolling in new contracts

- That the company HAS FRIENDLY INVESTORS ATTACHED (at last)

.. I feel like this is the turnaround moment, where a good deal finally gets itself in a place where it can grow to where it should be.

If the next quarterly financials show the company finally able to break even, this would be the point where Plurilock’s promise can finally begin to be fulfilled, and that initial run you can see in this past week could be just the beginning.

— Chris Parry

FULL DISCLOSURE: Not a client company, but I do own stock. Consider me conflicted all you like, but I may buy more if I see dips.