I’ve been meaning to do a story like this for a while, to help folks that can see the commodities markets are blowing up and would like to get in on some higher risk, higher upside opportunities.

It’s tough to get into resource investing from scratch. Indeed, before you make money on resources you almost have to lose money first, and learn hard lessons that will benefit you going forward.

But in this article, I’m going to try to show you a variety of companies that present differing business models and/or are at different places in their timeline, so you can figure out exactly what kind of company you’re most comfortable with.

None of these are inherently different from the others, they’re just all different. Let’s start from pre-listing.

THE EARLY BET: SAGA METALS (PRIVATE BUT COMING SOON)

Investing in a company before it hits the public markets usually means you’re an accredited investor with a broker who respects you enough to call you with ideas. To put that in context, of six brokers I have accounts with, only one calls me with opportunities and another is actively dodging my calls because I’m trying to sell shares in a deal he’s up to his neck in. Brokers really don’t do much brokering anymore..

Regardless, if you do have access to pre-listing financings, companies like this are REALLY attractive. This one has projects in Newfoundland and Labrador with an eye to extracting lithiunm, uranium, titanium, and vanadium.

Pre-listing financings are usually fairly generous, because the money they’re raising not only fuels early growth, but also announces to the market that in-the-know folks are interested, which helps fuel early stock surges.

In this case, Saga could be public any day now (the company usually doesn’t know an exact date until the regulators say ‘tomorrow’), and when it begins to trade, there’s likely to be a solid fan base ready to get involved.

Saga isn’t focusing on one metal, but rather a series of ‘green’ metals, in that they’ll all fuel the green energy biz, and is doing so in a location that a lot of peo0ple have long ignored, but which wants to kick start their local industry.

Another point worth making about Saga is, they’re working hard and fast on their projects, having committed to working their uranium project immediately, and their lithium project shortly thereafter. That lithium project is a stone’s throw from a Rio Tinto project, which puts them in big company. In the last few months, they’ve also been cutting their way through the brush to their titanium prject in expectation of having crews there working soon.

An AWFUL lot of exploration companies don’t commit to more than the minimal amount of work they can get away with, spending money raised on the executive team rather than in the ground. Saga has gone the other way.

IN A NUTSHELL: An IPO with wide green energy metal exposure in an untapped part of the country, committed to immediate work across multiple fronts.

THE BIG SWING BET: AZINCOURT ENERGY (AAZ.V)

If you looked over Azincourt’s news releases over the last six months, they could be accurately summarized as follows:

- Azincourt gets permits to drill East Preston project

- Azincourt does test drill day at East Preston project

- Azincourt readies for drilling at East Preston project

- Azincourt completes drilling at East Preston project

What’s missing from the above?

Yep, ‘East Preston uranium drill results.’

In the lifespan of any mining explorer, the world waits for two kinds of news releases: The results, and the acquisition. Everything else is a drumroll.

And over at Azincourt, everyone is waiting for the results from this year’s drill program right now.

The final tally on their drill program could turn this super-cheap stock into a fast mover, or it could turn the company into a Facebook Marketplace listing for used office furniture.

For Azincourt, the East Preston is the entire nuts. A uranium project that’s the subject of a joint venture with Skyharbour Resources (SYH.V) – (more on them later), Azincourt’s $8m market cap is something akin to a 12-1 racehorse lining up for the Saturday maiden handicap. If you toss a few bucks at it and it loses, oh well, nothing much lost.

But if it wins, you’re dining on steak tonight.

Azincourt just raised $375k at $0.035 per share, which seems crazy low on both counts, but the major selling point here is, with a half cent being the minimum amount a stock can move up or down, every single price shift represents a whopping 14% movement. Worth noting: Azincourt is committed to putting every cent of that into the ground, and none on promotional or IR activities. Like a dentist who just confirmed you have insurance – drill, baby, drill.

Azincourt could roll back its stock tomorrow and take the share price to $0.35, a figure people at the country club would nod respectfully at, but the action here is in the chance to (maybe) jack your money hard with every piece of good news and/or investor deciding to drop a grand on the stock.

Conversely, anytime someone sells, things go hard the other way. Such is life.

Azincourt is betting investors are more hyped for that upward notch than the down, so they’ve avoided the rollback that so many of the suit-and-tie crowd would advise. They’re keeping it dirty. They’re not only staying in the deep grass, they’re setting up camp there.

If, upon doing that, the upcoming news (and it could drop any day now) is that they’ve hit uranium paydirt, a share price movement of only a few cents could near double your money. For those that want to get rich quick, that’s mondo appealing. The risk of ending up in the other direction is there, for sure, but that’s the game.

Some people bet on red or black, some place their bets on #32. Choose your own adventure, chief, but now’s the time to decide.

THE REHAB BET: ALASKA ENERGY METALS (AEMC.V)

In the public markets game, promotion of a stock is important, even if it’s also a dirty word.

If you’re not telling your story, you’re buried under 2,000 other companies that are telling theirs, so a lot of companies will end up spending more than they should, on programs that can run the gamut between good solid info (that’s us) and crazy hyperbole (that’s most of the others).

- When promo doesn’t work, everyone frowns and says never again.

- When promo works, everyone cheers and talks about how smart they are.

- When promo works too well, the stock can run too fast and be ripped to shreds when everyone races to be the first one to sell.

That was this bad boy. A super-run on the back of a lot of promo, killed when the programs ended and the promoters sold their hand. leaving management holding a rough looking stock chart and some actually pretty good projects.

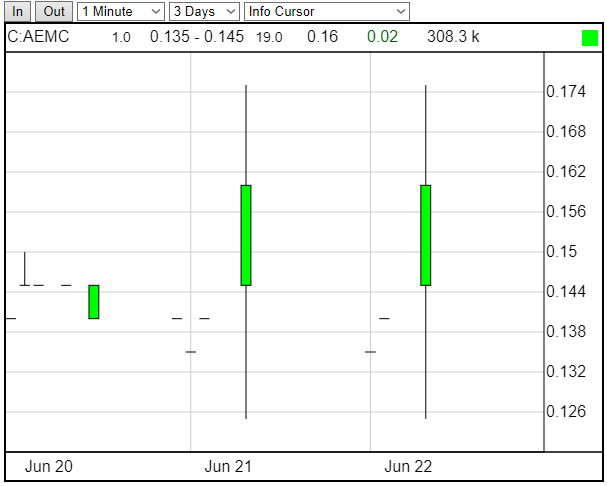

For the last few months, when investors look at AEMC, they’ve seen this:

Oof. But trim that chart a little on the timeline axis, and it looks like this:

I’m a fan of socks like this for three reasons:

- I feel like management learned some lessons the first time around and will dial things back next time

- Enough time has passed between the big drop and today that any weak hands have had their chance to move on (check ou those wild swings in the last few days)

- The projects

Let’s just take a moment to talk about those price swings.

Someone has been buying this thing up hard, and someone else has been selling it as hard. For a stock to fly up and down around 40% of its value means to me that there’s still folks looking to exit, but someone is willing to eat all their cheap paper as they do so, and then some.

The projects are its flagship Nikolai Ni-Cu-Co-Cr-Fe-PGM project located in Alaska, and they have a secondary project in Quebec focused on nickel, known as Angliers–Bellterre.

The Nikolai has had around $30m spent on previous work, and it has a compliant resource estimate of 4.225 billion pounds of nickel inferred and 3.871 billion pounds of nickel indicated.

All that for a $15m market cap?

Now the dust has settled on 2023, it’s nearing time to sneak back in.

THE FREIGHT TRAIN: DEFENSE METALS (DEFN.V)

If Azincourt and Alaska Energy Metals have an element of dice roll about them, Defense Metals has more an inevitability.

We’ve been talking up this deal, on and off, for several years now and it’s always been the same story: They’re doing the work, they have a good property, and they continually show their worth through their actions.

Last time we talked them up was in December/January, when the stock ran from $0.15 to $0.28, and we simultaneously pointed out their $130m neighbour (Neotech Metals – NTMC.C) was a total pump running off Defense’s coattails, which took them from $4 down to $0.80 in the same time.

NTMC is now at $0.27, and finally promising to do some work ih the form of a grab sample – while DEFN is building the financing team needed to move to production and bringing aboard executives from the World Bank and Lehman Bros as directors.

Defense Metals is in the rare earths game, which is a sectore that has stumped many over the years but good, smart people in the know see this project as a model for the way small mining explorers should become less small mining producers.

The stock hasn’t reflected that growth recently, but it will. In the aforementioned horserace, this filly is running with 3-1 odds, and has a chance to progress to the Preakness.

THE COUCH CUSHION BET: ATCO MINING (ATCM.C)

- A $2.3m market cap.

- Uranium.

- A good team.

That’s the pitch. We could prattle on about technicals but its early and those technicals are being fleshed out.

We could go on and on about the Athabasca region of Canada and how its basically Uranium Land and has a landscape pocked by companies driving drills into the ground, finding radioactive stuff, but y’all know that.

Atco is a contender, having bought in inexpensively and being teamed with the Standard Uranium (STND.V) squad (more on them later) that has a rep for knowing the region and building up a posse of properties without blowing the budget.

But Atco isn’t the biggest, it’s project isn’t guaranteed to be the best, it’s share price is small, and its aims moderate.

What it is, is a decent and inexpensive bet on Canadian uranium, where if you’re a mid-sized investor with a little bank, you can be an outsized influence in the investor base and potentially move the market on the stock like a boss.

“Atco is tremendously enthusiastic to expand it’s efforts in the clean energy space with ability to explore for uranium in the Athabasca basin,” stated Neil McCallum, director of Atco Mining. “The Atlantic project is an ideal target, as Atco will be leveraging the industry-leading talent of Standard’s exploration team.”

Cool, but he could have easily have said, “We’re not covered in dust, we’re not chiseling rocks and wading through lakes, but we’re in business with the guys who are and we’re paying the bills while they explore for us because that’s how we can progress things quickly.”

Also, they have a salt-based hydrogen storage play that’s rumbling on in the background.

And I’m down with that pitch. Sure, take some of my money. Let it ride for a season or two.

THE PROSPECT GENERATOR: STANDARD URANIUM (STND.V)

If Atco’s one-project, all-or-nothing bet is a bit too focused for your blood and you prefer playing Yahtzee to craps, Standard Uranium (STND.V) is perhaps more your jam.

STND did the all-or-nothing a few years back and ended up with the nothing, courtesy of a bad winter and a frozen drill, so they spent the next year spreading their best and quickly collected (count ’em) ELEVEN PROJECTS.

To be sure, they won’t work all eleven, but they have been active across several, have been working with partners, and when uranium takes another streak through the church at some point over the next year or two, you can bet they’ll be the place where latecomers go looking for their ‘new uranium projects’, putting Standard in the catbird seat for a whole lot of new money.

A respected management team AND a respected geo team that other companies have tried to headhunt over and over, there’s a togetherness about this squad that speaks to the opportunity (or opportunities) behind it.

And, of the projects, the group just announced some results from the Atlantic project they’re drilling for Atco.

The highlights:

- Confirmation of Uranium Mineralization: The company reported significant uranium mineralization in multiple drill holes (ATL-24-002, ATL-24-004A, and ATL-24-005A).

- Strong Geological Indicators: The presence of dravite-rich clays and structural disruptions within the drill holes indicates a geologically active area with conditions that are favorable for uranium deposits. The identification of multiple uranium pathfinder elements further supports this.

- Unexplored Potential: There are several kilometers of untested strike length along the project area that could prove significant.

- Planned Follow-Up Exploration: Standard Uranium has outlined plans for further geophysical surveys and continued drilling.

- Verification of Exploration Thesis: The initial results have verified their thinking that the underlying assumptions about the geological potential of the area are correct.

Unspectacular but consistent; that’s been Standard to this point, and while the stock price has slid for several months, now might be a really good time to lock in because they’re going to be working through the winter and I can’t see them standing still.

THE VALUE BET: BEYOND LITHIUM (BY.C)

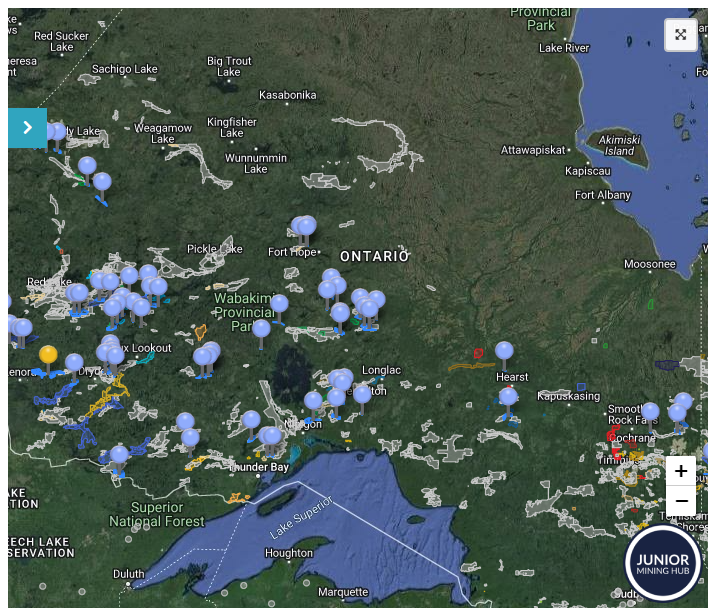

When lithium was having a moment last year, nobody blnked an eye at Beyond Lithium’s (BY.C) big run up, being as nobody owned more Ontario lithium properties than them, with the number currently sitting at a whopping 27 projects.

In fact, BY’s exploration team were awarded the prestigious Bernie Schnieders Discovery of the Year Award for their 2023 spodumene discovery at the Victory Project in Ontario, from the the Northwestern Ontario Prospectors Association (NWOPA), which is no small thing. Past recipients include Great Bear Resources, Frontier Lithium, and Delta Resources.

That said, few are buying lithium stocks right now, no matter the discovery, so the market cap of this one-time unstoppable growth explorer has shrunk to just a few million bucks. That’s INSANE, especially considering the company raised half of that figure toward the end of 2023.

I’m not about to tell you that everyone’s going to be looking for lithium properties this time next month but they will at some point and, when that happens, Beyond is going to be arbitraging the shit out of their portfolio.

For now, they’re free to do a little exploration at their four primo properties and wait things out while lithium as an industry evolves. The stock chart is filthy, but if you figure each of those projects is worth $200k, this is a triple if being sold for parts and cash in hand.

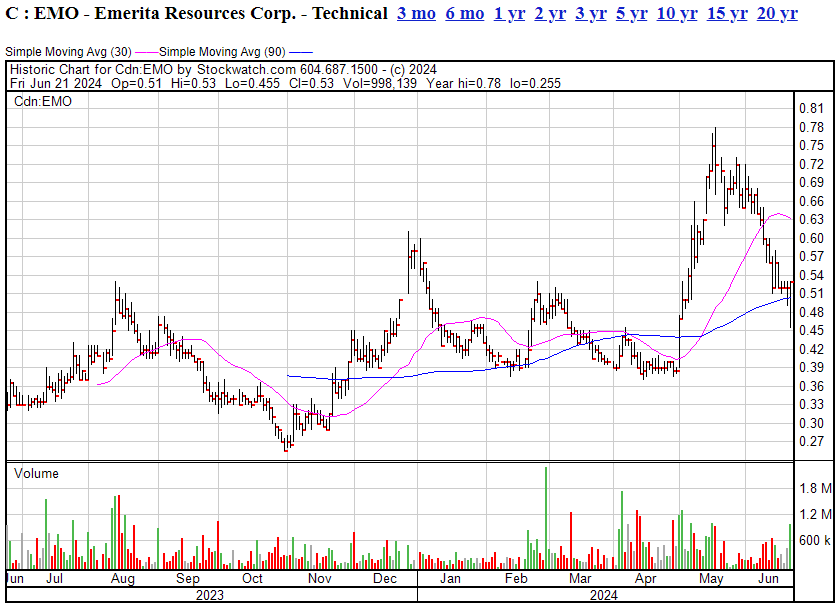

THE ‘SET AND FORGET’ BET: EMERITA RESOURCES (EMO.C)

EMO is a great little outfit, with a solid zinc project in Spain, the IBW, that is really fleshing out, but the value here is in another project that they’re not working at all.

That project is an utter monster – a company maker – that is likely to be theirs within the next year via a court case.

See, back a few decades ago, EMO made a bid for a large mining project that had been shuttered after a disaster, and was finally coming back to life. The problem was – allegedly – the govt officials running the proposal process to see which company would get the rights to the mine, rigged the outcome in favour of another group. When that allegation came out and went through the courts, the project was once again cottonballed while an endless array of courtcases and processes and delays played out.

Well, that process is due to come to a head in 2025, and if Emerita wins (and it wouldn’t be going to trial if it didn’t look like they would), they’ll suddenly own an absolute fucking beast of a project.

If they don’t win – because hey, you never know – they’ve still got an amazing project to lean on.

But if they DO win, you could add a few digits to their valuation.

I’d bet good money they’re going to be happy at the end of things.. and you can too, by buying the stock.

Trade it if you want, but for me this is a situation where you buy it and lock it away for the grandkids. One day, I don’t know when, this will be a massive story.

At least that’s my guess.

THE RUNAWAY BET: RAMP METALS (RAMP.V)

We told you this was going to be all about the company proving FAST that it was going to be a driller, right out of the gates, and sure enough they blew the pants off the market with a fat drill hole, showing 7.5m of 73.55 g/t gold at the Rottenstone SW Project.

And all that in a place nobody has made a big discovery before.

That’s a hell of an introduction to the markets and it doesn’t look over. The stock has been climbing every day as the word drips out to people who haven’t heard about the company before.

A lot of times, if you miss the day when big news drops, you’ve missed the rise.

In this case, because the company is new – and un-promoted to this point – a lot of people are still finding out about it a week later – and those who were already in, they’re not selling.

Ramp isn’t a client – none of these companies are at the minute, in fact – but we called it out of the gate and if you listened – YOU’RE WELCOME.

But the fun isn’t over yet.

THE DIFFERENTIATOR PLAY: LANCASTER RESOURCES (LCR.C)

Traditional mineral exploration is a bit of a boys’ club. It’s not that there aren’t women in the business, in fact the number of women in resources is ramping up hard, but when you look across the PDAC floor, you don’t see a whole lot of heels, and even less in the boardrooms of power.

So a woman led lithium company stands out a little.

Add to that, that she’s determined to make the company a net zero company, meaning the company will create a carbon-free supply chain, and you start to really see the differentiators emerge.

As a full formed liberal, who supports mining as necessary but also gives a shit about the planet, and would like women to get the same chances as middle aged white guys, Lancaster gets an extra nudge of support from me.

The company has a brine lithium project in New Mexico, and a hard rock lithium project in Quebec, so it has the industry pretty well covered. They/ve been building an advisory board, which is smart for a small explorer that’s going to need to punch above its weight class to progress, and it’s also not averse to utilizing satellite tech, solar energy, and AI to isolate and progress targets.

Plans are afoot to drill the NM property, like, now, so I’d expect this microcap lithium deal to start making news pretty shortly.

The stock price is not pretty and paints the deal as too small to get seriously big, but that can change in a heartbeat with the right results on the exploration side, and the project ni fovus is right on major infrastructure n rail, highway, geothermal energy, and water access 9which a lot of groups in the US Southwest don’t have).

Worth a flutter, or at least worth watching.

THE SMOOTH OPERATORS: SKYHARBOUR RESOURCES (SYH.V)

We’ve been saying it for months, but no uranium explorer is closer to a fat pay day than Skyharbour Resources (SYH.C). You can point to anyone you like, any project, at any level, but the collection of projects under the Skyharbour banner, the cash in hand, the line-up of partners doing work for them, or sending them cash, or both, and the strong likelihood that one of those projects or more will be picked up by a major during the next uranium bull run has them, for my mind, on a very special launchpad.

We’ve been saying it for months, but no uranium explorer is closer to a fat pay day than Skyharbour Resources (SYH.C). You can point to anyone you like, any project, at any level, but the collection of projects under the Skyharbour banner, the cash in hand, the line-up of partners doing work for them, or sending them cash, or both, and the strong likelihood that one of those projects or more will be picked up by a major during the next uranium bull run has them, for my mind, on a very special launchpad.

Just check out the screenshotted list of news headlines over the past few months from these guys, over on the right hand side of the screen – it’s all exploration, all the time.

Falcon, East Preston, Russell Lake, through Azincourt, Tisdale, north Shore, and while all that is going on, Skyharbour continues to stake new land and pick up new options.

While most of the companies mentioned above are small players hoping to grab the brass ring, more than a few of them are actively seeking the attention – and some getting it – of Skyharbour as a partner.

That’s because SYH are connected to much bigger fish, are in regular communication with them, and could at any point (considering their more than reasonable $69m market cap) just be sized up and taken out by one.

The uranium market can be a fickle beast. We all know nuclear is going to ramp up as a green energy source going forward. We all know modular reactors are an increasingly accepted thing. And we all know modern nuclear is a safe enterprise with minimal carbon emissions.

Tie in some international warfare holding up traditional uranium production around the world and it makes sense that companies like Skyharbour will, very soon, become super attractive to bigger players who’ll need new ground, reliable operators, and taps they can turn on fast.

For mine, SYH is a portfolio company, not a trading target. Buy a little, sock it away, ignore daily ups and downs and wait for the inevitable maturity event.

THE ALL OR NOTHING BET: TISDALE CLEAN ENERGY (TCEC.C)

Here’s TCEC in a single sentence: They saw a property they really liked, and paid what they feel is an approriate amount to jump from microcap player to potential midcap player.

That’s the pitch.

Tisdale is a small exploration outfit with a small market cap, partnered with the aforementioned Skyharbour, and they’ve committed themselves to the South Falcon Easty project that contains the Fraser Lakes B uranium/thorium deposit with a historic (non-compliant) mineral resource of 6.9 million pounds (Mlb) U3O8 (triuranium octoxide) inferred at a grade of 0.03 per cent U3O8 and 5.3 Mlb ThO2 (thorium dioxide) inferred at a grade of 0.023 per cent ThO2.

How committed are they?

It’s going to cost them $10.5m in exploration costs, $4.6m in cash, and $6.5m in shares to get 75% of that play.

To be sure, if they’d farted about and risked the chance other companies might have swooped in and got the property, they may have haggled for better terms. But Tisdale cEO Alex Klenman feels like he got his franchise player in this deal, and that you get what you pay for.

He may be right. Skyharbor CEO Jordan Trimble has stepped onto his advisory board and obviously has a real interest in seeing the project move forward, so that’s not a bad friend to have in your back pocket. That Skyharbour wants to hold on to 25% of the project tells me they believe there’s plenty to of interes in it internally, and TCEC has five years to pay off those terms.

Other companies that owned the property previously have been stabbing holes in it since 2004, and found enough happiness in their results to keep sinking them and adding to the resource estimate. That’s TCEC’s plan too – work as quickly as they can, satisfy the requirements of their option, and let the results of that work pay for years 2, 3, 4, and 5.

They’ve already been at it in early 2024.

The market expects more, so expect the drill to keep turning.

THE FUTURE-PROOF BET: ZEFIRO METHANE CORP (ZEFI.C)

Okay, wait a minute. We’ve talked a lot about exploring in the thousands of words above, but we haven’t done much about ‘services’, and this one is a little bnit out of left field.

Everyoe talks about carbon abatement, storage, credits, but few talk about methane, which is in actuality a bit more of a problem.

A lot of derelict oil wells, long plugged up, aren’t actually that plugged and instead leak copious amounts of methane, much to the annoyance of governent, and local communities.

As oil well owners are usually not eager to spend the money to fix such issues, government bodies are offering subsidies, grants, and straight up contracts to folks who will.

Enter Zefiro.

These guys have crews on call that will locate leaky wells (of which there are thousands), track down the owners and govt bodies, and negotiate to mitigate the problem.

When the work is done, Zefiro not only has money in pocket, but also has carbon credits in hand that can be traded for fat profit.

I love these kinds of deals, where everyone wins, we fix real problems, and I can still make profit off the side. Let’s fucking go.

That’s it for now. Add them all to your watchlist and pick your entry times like a sniper.

— Chris Parry

FULL DISCLOSURE: None of the above companies are current clients, though many have been clients in the past, some are companies we own stock in, and others may be clients in the future. None of the above has been written by or approved of by the companies in question, and we provide all of the information for journalism purposes, to support companies and management we believe in, and to keep investors who may have take a position while the companies in question WERE clients in the loop.