We’ve been talking up this platform we’ve been working on for a while, that we’re using to go through every damn exploration company we can find, trawl through their paperwork, and extract easy-to-understand details so folks can get an at-a-glance idea of what lurks beneath the paperwork.

We feel that, if we can perfect it, we’ll transform the resource exploration business into something anyone can understand, happily invest in, and avoid many of the pitfalls of, for time eternal. There’ll still be risk, but that risk won’t be hidden anymore, and that changes everything.

In building the platform and doing some testing, we’ve found some really nice deals that were hiding in plain sight, but one just popped out that I’m super excited by.

This is a deal just sitting there, waiting to be discovered by investors, right out in the open, but like every resource exploration deal, it’s hamstrung by regulatory requirements that insist management speaks to you in coded language, or even not speak to you at all, which hides it from anyone not digging in deep.

Well, we dug in deep.

Here’s an example of the ‘inside baseball’ stuff I’m talking about.

[Company name] has received a notice from the Polish Ministry of Climate and Environment indicating that it plans to complete the transformation process by April 30, 2024, for two concession licence areas in southwest Poland: Bielsko-Biala and Cieszyn. The notice is related to the company’s formal submissions of the application made to the ministry in August, 2023, and subsequent clarifications and information to the ministry submitted in early February, 2024. The transformation process is fully described in the annual financial statements and management discussion and analysis but in summary, a transformation of the concessions to the new Polish concession laws is necessary as a result of the implementation of amendments to Poland’s geological and mining laws. The transformation process had been initiated by [company name’s] predecessor company in Poland [..] but was stalled during the COVID pandemic.

Cool? You got that?

Well, let me break it down for you in super layman’s terms.

There’s oil and gas all over the globe. We think of it as a Saudi, American, Russian, and Canadian thing, but there have been millions of holes stuck in the ground over hundreds of years that came up with oil and gas, just not always in amounts or types that are easy or economic to process.

In fact, even suburban Pitt Meadows BC, just outside Vancouver, was once a proposed oilfield, with drillers finding enough of the stuff to warrant massive newspaper stock promotions that, ultimately, came to nothing because.

In fact, even suburban Pitt Meadows BC, just outside Vancouver, was once a proposed oilfield, with drillers finding enough of the stuff to warrant massive newspaper stock promotions that, ultimately, came to nothing because.

- Finding gas isn’t hard.

- Finding gas in quantities that are economically viable is.

- And finding that economically viable gas in places close to a pipeline is.

Now, ‘economic’ is hard to define because, over a long enough timeline, with commodity prices rising and falling over the years, a lot of uneconomic discoveries eventually become economic. Gold was worth $300 an ounce not too long ago, whereas now it’s worth $2500. A few years back, oil was worth so little, futures went into negative territory for a spell. Alberta oilsands properties weren’t economic until a combo of price action, pipelines, and processing technology made them so.

In Europe right now, gas prices are going nuts, because the war between long-time oil and gas suppliers Russia and Ukraine has the former under sanction, and the latter under daily artillery barrages.

France and Germany aren’t developing more gas fields, and they’re still unplugging nuclear reactors, so the rest of Europe has begun looking inward at resources that, for a long time, made no financial sense, that might now be worth using to supply themselves AND other nations.

Such is the case in Poland, where large groups have long sold natural gas domestically from free flowing wells, but with cheap Russian and Ukrainian options available, there wasn’t any real need to look to tier 2 projects, or explore for new ones. That left a lot of ‘nice little earners’ out there for years, not being worked, and largely being forgotten, despite having significant earning potential in an era where European nations are paying multiples more for gas than they used to.

And just when the time came to start re-considering those projects, Covid showed up and shut everything down.

That’s left a situation where, if you like to go through old exploration data, you can find some absolutely impressive opportunities out there in the world, and all they need to be running again is a little development capital, some government paperwork, and smart people who know how to operate them effectively.

Here’s one we found:

The Lachowice gas development project within the Bielsko-Biala concession has been independently evaluated to contain gross probable reserves of 34 billion cubic feet of natural gas with 261 million barrels of condensate as well as 2C gross risked contingent resources of 164 bcf and over 1,200 mbbl of condensate.

In layman’s terms:

The Lachowice gas development project, located in the Bielsko-Biala area, has been independently assessed to have:

- 34 billion cubic feet of natural gas that is likely to be extracted.

- 261 million barrels of liquid hydrocarbons (condensate) that can be produced.

Additionally, the project has:

- 164 billion cubic feet of natural gas that could potentially be extracted under certain conditions.

- Over 1,200 million barrels of condensate that could also potentially be produced.

This project is super close to existing pipelines, covers 279,000 acres across two licenses, with options to grab 466,000 acres more in the Rotliegendes natural gas basin.

The Bielsko-Biala concession details:

- Discovered in 1986

- Seven wells drilled between 1986 and 1996:

- 7 wells confirmed 130m – 300m gas columns

- 3 wells tested gas at commercial rates up to 8.9 MM scf/d

So why didn’t it get more attention?

Timing – and poor practices. The wellbore integrity was reportedly compromised by poor drilling and operating practices. Plug some folks in who know what they’re doing and this could be a big deal.

The company involved here is Horizon Petroleum (HPL.V.H) which is run by Chairman and CEO Dr David Winter, and right now is quietly doing the paperwork to be a PRODUCING natural gas company in the near future.

Dr Winter has a PhD in structural geology, and was the founder, Chief Executive Officer, and Director of Excelsior Energy Limited, which provides project manasgement services to global resource and mining companies. He’s also worked for British Petroleum (BP), Sun Oil, Canadian Occidental (CNOOC), Alberta Energy Company (now Ovintiv), and Calvalley Petroleum. I called him up and asked what he’s doing and I’ll say this: He’s legit.

He wouldn’t/couldn’t tell me much because they have to stay quiet during the process, but confirmed our thinking that they expect production to be a near term goal if all goes well with the paperwork.

From a recent news release:

..in anticipation of the successful completion the company has:

- Begun initial preparatory works required for the retesting of the Lachowice 7 (L7) well and associated early production facilities required to start producing gas and establish the company’s first cash flow.

- Testing of this well by previous operators attained rates as high as 8.9 million standard cubic feet/day with a sustained rate of three mmscf/d over a two-week extended test period.

- Executed two memorandums of understanding with oil field service companies which will be engaged in the initial well workover and testing;

- Initiated discussions with the local power utility to determine technical and operational requirements to deliver electrical power into their system initiated discussions with potential suppliers of a temporary gas-to-power (G2P) facility;

- Completed a preliminary environmental study at the Lachowice-7 well site.

The Lachowice gas development project within the Bielsko-Biala concession has been independently evaluated to contain gross probable reserves of 34 billion cubic feet of natural gas with 261 million barrels of condensate as well as 2C gross risked contingent resources of 164 bcf and over 1,200 mbbl of condensate. These independently determined reserves were disclosed in more detail by press release dated Dec. 5, 2022.

Says the boss-man:

“The expected granting of the two concessions will mark the end of the process to convert the two concessions to the new Polish concession law. The COVID pandemic imposed travel and work restrictions contributed heavily to the lengthy delays experienced during this process and final approval will be a[n] important step in moving Horizon towards its goal of commencing operations, production and cash flow from its assets in Poland. Our experienced team in Poland have worked hard to finalize the required submissions and we look forward to working with the Polish ministry toward a successful development of the Lachowice gas field.”

What Dr Winter *could* tell me is the plan is to get to production quickly, generate revenue, and use that revenue in part to explore outward.

Dr Webster has done this before. For him, this is clearly less about ‘hope’ that the field will deliver, and more about simply putting the pieces in place that will get the paperwork signed off and the taps turned on. They know there’s gas there, that’s not in question, Horizon is simply going to do what they know needs to be done to plug into the local pipelines and deliver it in an efficient and streamlined way – something that hasn’t happened previously.

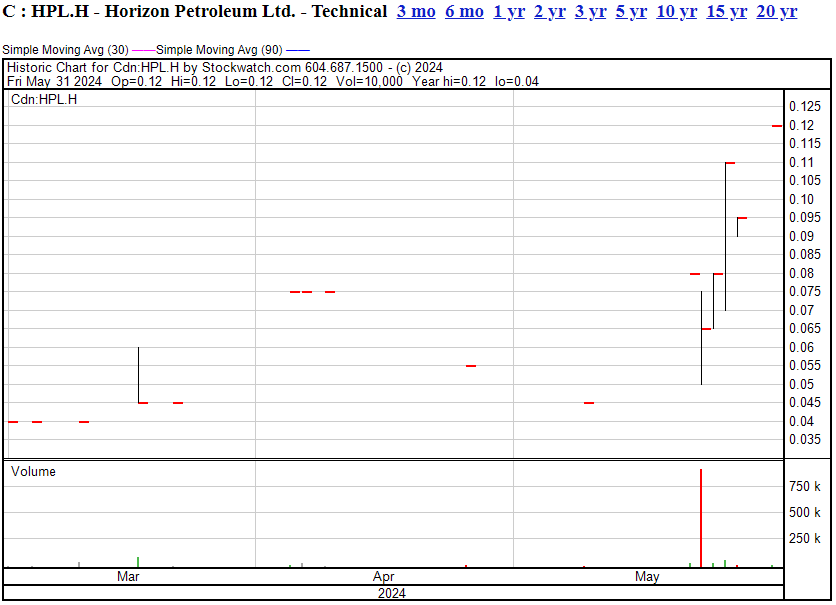

The stock is up from $0.04 in early May to $0.12 as of the week’s close.

As you can see, it’s not exactly the talk of the town, volume-wise, but that’s the opportunity for retail investors.

This company, which can reasonably point to a future where it can pull down $5 million in annual revenues in the short term, has a $4 million market cap.

What caused the jump?

Remember that technical terminology gobbledygook we referenced up top of this article, the talk about the “notice from the Polish Ministry of Climate and Environment indicating that it plans to complete the transformation process?” Here are the layman’s terms on that:

The Polish Government got an application to update the old exploration patch to modern standards to make it compliant with local modern exploration laws, so that the applicant can kick it into gear and get it producing.

That was what Horizon needed to do to turn this field around.

Which makes this, last week, all the more interesting.

The company has received written notification that the ministry has formally initiated the final administrative proceeding to submit the applications to various key government agencies for their review, approval and clearance so that the award and signing of the concession agreements can proceed. Official notification means also that formal requirements of the applications have been met.

The company wishes to emphasize that although it considers this to be a critical milestone in the process, there remain several key administrative steps by the Polish state that have still to be completed in order for the concession agreements to be signed. The company will inform the market when further updates are available.

it’s important for me to make clear, this is not a client company, and I don’t represent them.

I’m also not yet a shareholder (I published this at week’s end so as to be right there with my readers and not front-running you all), but I will be, come Monday morning.

I don’t know if the company is ready for people to know about it yet, but let’s fucking go.

I’ll be checking in with them again,

— Chris Parry