This year, the hot gold stock – the one everyone has heard of and a lot of people have made money on – is West Red Lake Gold Mines (WRLG.V).

Though it’s come off the heat in May after a double since November, West Red Lake is a bona fide beast – a Frank Giustra-fueled bulldozer, picked up for a song after others completely blew up the opposrtunity, running right up against Great Bear to the south, screaming toward production quickly and with no shortage of friendly investors/institutions/financiers.

Sometimes The Juice sits in the background and keeps his cards close to his chest, with his involvement being mentioned in hushed tones only by those close.

Occasionally, he grabs a megaphone.

This is a megaphone play.

Page 3 of the WRLG deck.

Right there in image and name.

Cool. I dig. I like.

But I missed the train.

WRLG went bonkers while I was looking at other things and the sweet sweet low cost positions were all filled and mulitplying in worth while I dithered.

Though it has had a rough month in May, some profit taking, some regulator kerfuffles, an amended raise – none of that is anything that group can’t handle, and there’ll be a time shortly where those wheels start churning again as the beast runs to production.

But I like me a double, and a $100m+ market cap company has to work hard to make one of those happen, while the little guys in their shadow can sometimes run multiples on a couple of good news releases. The trick is to find one that has something the majors might actually want.

And I found me one of those: GoldON Resources (GLD.V).

GoldON is not a beast. In fact, to look at it, you’d be excused for thinking it was a bit of a runt.

- Sub $3m market cap.

- Low share price.

- Small projects.

- Newsflow is all low 6-figure raises and debt settlement.

To the casual observer, this is empty calories. Another little explorer in a sea of little explorers.

But there’s something you may not have spotted in this.

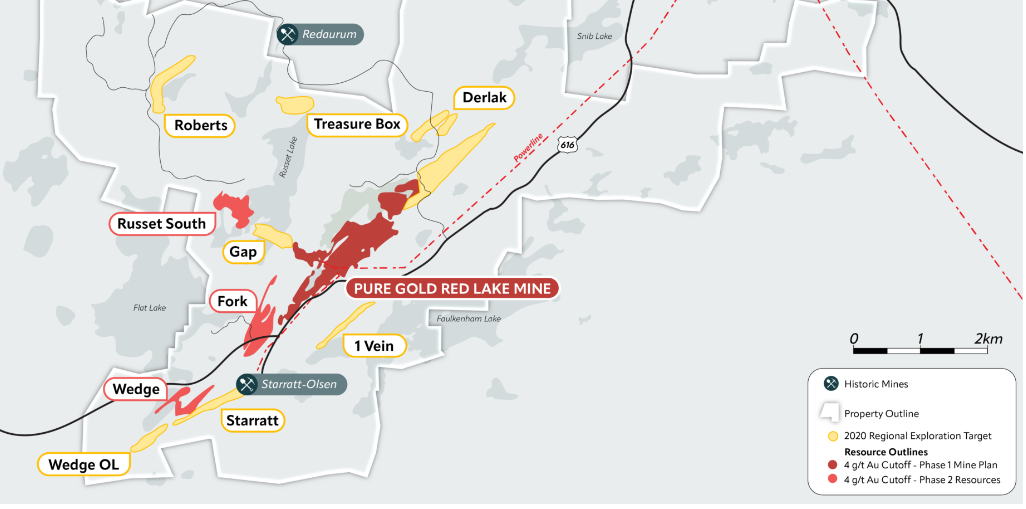

Here’s the West Red Lake property.

Note the black lines converging. That’s the sweet spot, and WRLG knows it. They’ve started exploring southwest down that line and slowly realized there’s more to that Wedge area than they knew.

You know what else is down there?

GoldON.

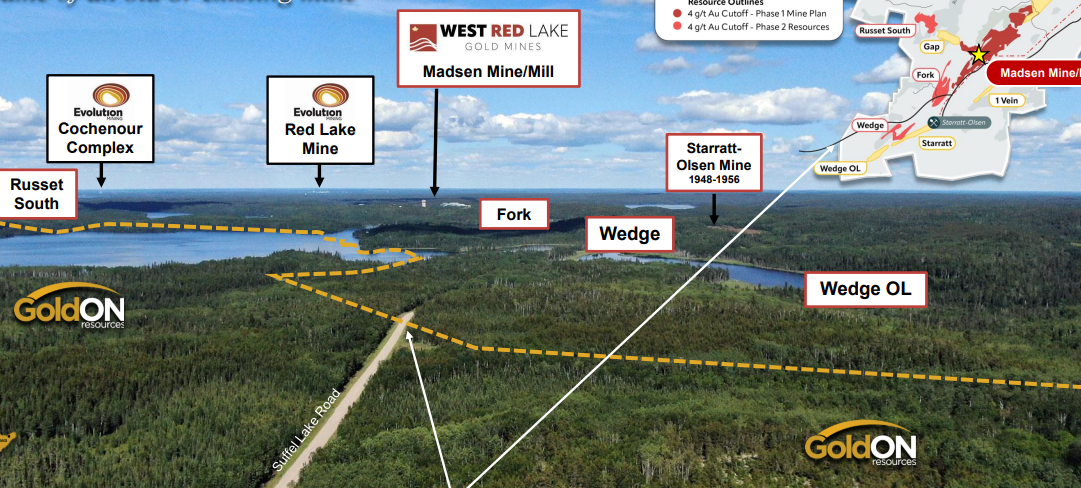

The Suffel Lake Road in the image above leads right through the WRLG land package and towards the mill.

Now, by itself, this might not be important. ‘Closeology’ plays aren’t a new thing and will often be more about marketing than exploration, but there’s every reason to believe this will be different.

First, GoldON acquired this property from Great Bear Resources, which was eventually taken out by Kinross and is one of the big Canadian exploration wins of the last decade.

Following in Great Bear’s footsteps was the plan behind West Red Lake from the outset.

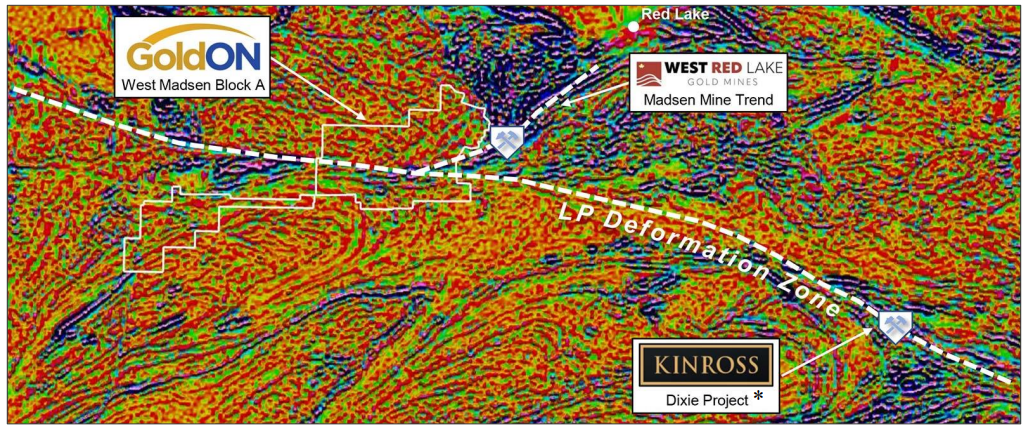

The image below shows where each of the three companies sits.

Each is on a deformation zone. Only one sits at the intersection of those, and it just so happens to be the cheapest of the lot.

A couple of years ago, PureGold (the company West Red Lake picked the bones clean from) drilled this entire area.

PureGold was a total fuck up.

Management was desperate to flip the thing for a big exit and so, rather than doing things that would benefit the property long term, like infill drilling, purchasing necessary equipment instead of renting, or even mining the best grade ore that was a little harder to get to, it took the cheapest up-front capex options and iffy debt, made poor operational calls, and loaded itself up with operating inefficiencies thinking they would ultimately be someone else’s problem.

When it couldn’t keep itself above water, a fire sale followed, and WRLG took over a once-billion dollar asset, with $350m having been put into development, for just CAD$6.5m in cash, US$6.8m deferred, a 1% NSR on the Madsen, and 40.7m WRLG shares.

Let’s be clear, WRLG is a bargain, even in the midst of its current churn.

But GoldON is even cheaper, if you don’t mind a little waiting while WRLG drills toward its southern border, right along those assemblages, which follow the line to where GoldON has already been through two drill phases.

From GoldON’s deck:

- The historical resources on the Madsen Mine property are hosted along a 7-km gold trend that follows the major crustal break between the Balmer and Confederation assemblages.

- GoldON has observed the same Balmer-Confederation contact in outcrop ~1.5 km west of the Block A eastern claim boundary and identified it within an ~8-km corridor of disrupted regional magnetics that traverses Block A from the Madsen Mine property.

- Drilling to date returned consistently anomalous gold values and highly prospective geology, which included visible gold in hole WM20-05 that intersected 14.4 grams per tonne (g/t) over 0.5 metres in strongly altered mafic volcanic rocks of the Balmer assemblage.

- Gold mineralization was also discovered in felsic intrusive rocks within the Confederation Assemblage through GoldON’s fieldwork and drilling. The eye-opener is hole WM-21-22 which intersected an anomalous gold halo with values of 0.158 g/t gold over 195 metres that included elevated values up to 2.2 g/t gold over 2.2 metres within a broader interval of 0.51 g/t gold over 10.9 metres.

BUT THAT’S NOT ALL:

There are three other projects under GoldON’s wing, but I hate posting maps and I’ve already posted a bunch so be damned if I’m going to go all wonk on you by posting more and boring you to tears with tech talk when it’s already clear this is a deal.

To be sure, those other projects are gravy, but the thing that keeps me up at night is this little outcrop of rock that GoldON sits on, that’s perched right along the rock that has already made people bonkers wealthy to the northwest and southeast.

To be sure, if one single hole GoldON drops comes up with decent numbers, WRLG is dragged closer and closer to just making an offer that can’t be refused.

To that:

- Kinross bought Great Bear for $1.8 billion.

- PureGold’s infrastructure spend alone was $350 million.

- WRLG’s current market cap is $146 million.

- GoldON’s market cap is just $2.9 million.

Ya think there might be a dollar to be made there?

— Chris Parry

FULL DISCLOSURE: Not a client but we’ve talked. I’m buying on the open market. Consider me conflicted either way, and do your own due diligence because, boy howdy, I think it’ll be worth your energy.