A few years back, for a hot minute, the investment world was consumed by a single word, that is until Mark Zuckerberg made it uncool.

A few years back, for a hot minute, the investment world was consumed by a single word, that is until Mark Zuckerberg made it uncool.

That word was “metaverse,” a concept where much of the physical world’s business, recreation, and more would take place in a Second Life-style version of the meatspace, played out on servers instead of streets.

It didn’t exactly catch on, in part because to really reinvent, like, the entire world as a virtual 3D 360-degree simulation we can all login to and live in, would require a massive amount of digital infrastructure that we’re years from building out, even with the much vaunted 5G communications network being rolled out worldwide.

So the metaverse bubbled for a moment, then died.

As did volumetric capture, and virtual reality, and augmented reality – at least as a monetizable now-tech.

Large scale heavy-duty compute bandwidth simply wasn’t available to meet the needs of internet 4.0 back then and, since those days, the demands of crypto and now artificial intelligence have made things even harder on the computing power side.

The hottest company in investment circles this year? Nvidia (NVDA.Q), makers of the graphic processing units (GPUs) that are at the center of all of these tech advances.

Without GPUs, you can’t run the metaverse, nor mine crypto at scale, nor build out ‘the Netflix of video games’, and the increasing demands of artificial intelligence (AI) basically use high powered computer power as currency.

SO HOW DO WE PROFIT FROM THIS?

Picks and shovels.

Yes, you can pile on to NVDA like everyone else’s grampa, looking to play AI via computer chips, but that stock is so heavily bubbled already there’s every chance you’re going to ride a hard correction downwards without much notice.

Look smaller.

I was a big proponent of AMPD (AMPD.C) a few years back, which was anchoring itself in the high-powered computing business but got distracted by the metaverse and ‘too soon’ed itself to half a cent (though I’m told they’re still in there swinging). The old adage that the first one through the wall gets a broken skull has some truth in it, but ALSET Capital (KSUM.V, OTC.ALSCF) may have timed its run just right to clamber into the high powered computing world right as it hits maximum demand.

WHAT’S ALSET?

ALSET Capital is uniquely positioned in the burgeoning AI industry through its 49.0% stake in Cedarcross International Technologies Inc., a company harnessing the power of NVIDIA’s cutting-edge H100 GPUs. This investment places ALSET at the forefront of the AI cloud computing hardware sector, offering significant growth potential in a market driven by insatiable demand for advanced computational capabilities.

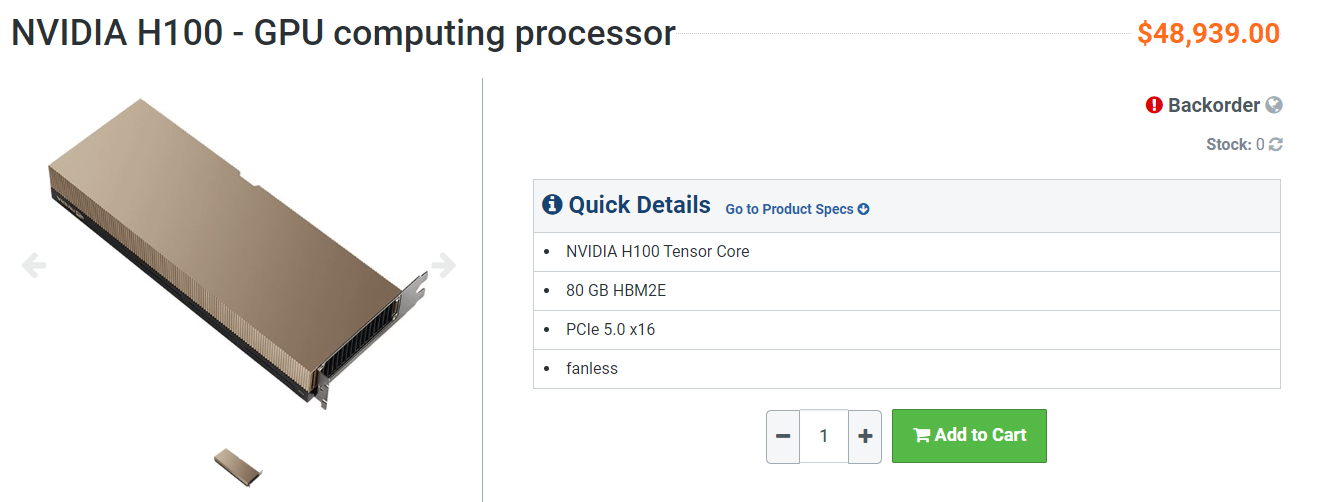

Cedarcross has significant access to NVIDIA H100 GPUs, which are essential for training sophisticated AI workloads because they provide the immense processing power necessary for handling complex AI tasks. NVIDIA’s GPUs are so central to AI development that they have become a gating factor for AI’s projected multi-trillion-dollar impact on the global economy.

The NVIDIA H100 an extremely powerful tool for a wide range of AI applications, including machine learning model training, inference, and other data-intensive tasks. The combination of high-speed memory, powerful processing capabilities, and advanced connectivity options positions the H100 as a leading choice for enterprises seeking to leverage the latest in AI technology.

In layman’s terms; If you don’t have them, you’re not a serious player.

ALSET, through Cedarcross, aims to democratize access to these powerful computing resources by leasing them to enterprise clients, a business model that not only meets the growing demand for AI computing but also expects high profitability with gross margins on its compute leasing business unit projected at approximately 80%, and a hardware payback period of about 1.5 years.

In addition, the company’s access to servers has enabled them to establish a high-performance computing server distribution business unit, which has already achieved approximately $28m cumulative reneue, year to date.

The high demand for H100 servers, combined with Cedarcross’s unique hardware supply and data center relationships, strategically positions the company to capitalize on the rapid growth of AI technologies, and the significance of computational power in the AI sector was recently underscored by Sam Altman, CEO of OpenAI, who highlighted “compute” as the future’s currency.

Here’s the thing: Just because you want an H100 server doesn’t mean you can get one.

Backorder, babes.

I found one available on Amazon, but for a $10k markup above the $48k regular price.

But ALSET and Cedarcross can get their hands on the product and make them available for lease, and have ten such servers at hand currently, with aspirations to get their hands on 250 through 2025.

This is big news for companies like mine, which have increasing AI needs that don’t fit into the one-size-fits-all of ChatGPT. We’re building out an AI-based tool currently that quickly evolved away from the restrictions of consumer AI platforms and demands its own iteration that we can control, train, and utilize. We’re EXACTLY the sort of company ALSET is aiming at, with its ability to let us use their servers for our own specific needs, without being slowed down by a large scale shared userbase.

If we need bandwidth, we pay for the bandwidth, but we sure as hell aren’t going to drop $48k on our own physical server, so the ALSET solution is perfect.

As AI increasingly becomes a business tool for all, not just a series of giant platforms owned by mega corporations, there’s going to be an increased need for companies like, frankly, mine, to lease TIME rather than hardware, and ALSET is right there where the puck is going to be.

Currently the company boasts a $23m market cap, but if it can crank out a few deals with suppliers and clients, that can quickly scale.

That’s what we’d be looking for in the months ahead; genuine indications that the 10 x H100s in ALSET’s hands can multiply, because demand right now is FAR outweighing supply and to the supplier go the spoils.

— Chris Parry

FULL DISCLOSURE: Equity Guru has been hired by Omni8 Communications Inc. on behalf of Alset Capital as announced in Alset’s news releases dated March 27, 2024 and May 14 2024 for content creation for the company. The agreement is for one month starting April 2024, for $4000.