Imagine, if you will. someone came to you with a request to borrow some money for a business.

The money would be used to buy an old, end-of-life oil well. A sputtering little hole in the ground that’s not producing much and, to be honest, is more gas than gasoline.

“Why would you want to buy that?” you might ask, and your friend will say, “I’m going to plug it up.”

This might seem counter intuitive, but your friend has a plan. They’re going to stop methane from leaking out of that well, then they’re going to arbitrage the carbon credits they’ll earn from cleaning up the well, and then they’ll earn money from those carbon credits going forward WITHOUT REMOVING ANOTHER DROP OF CRUDE from the well going forward.

Clean the well, get paid.

What’s more, the government will often pay to clean those wells up, so you’re making money twice.

Is this actually a thing?

It appears so. Carbon credits are big business, and getting bigger. Global companies that have to create pollution as a part of their general businsss practices (which is most global companies) will often offset that pollution by buying carbon credits, whiuch come from other companies and organizations that limit or eliminate pollution elsewhere.

The whole system is basically an admission that we can’t eliminate all pollution at the source, but we can make polluters fund good works elsewhere that offset their damage.

- Fly a plane to Austin, plant 75 trees.

- Run a truck from Hamilton Ontario to Vancouver Island, contribute a hundo to a wilfelife refuge.

- Use packaging to ship your products to online customers, invest in a plastic recycling facility.

The object isn’t to end pollution per se, but to allow companies to lower it massively by investing in things that help.

So why oil wells?

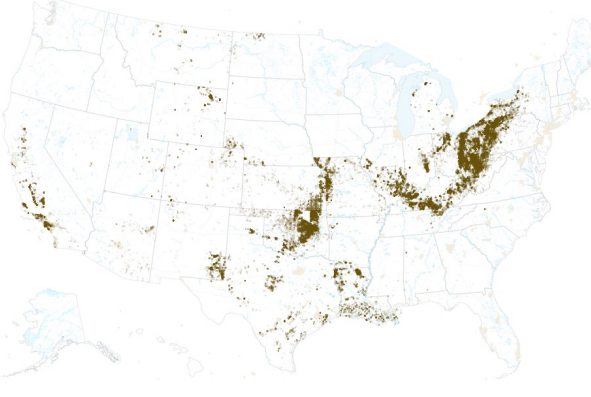

Because there’s been literal millions of them that have come to an end of their useful life just in the US, especially on the east coast, whereupon the owners of these wells generally turn the taps off and just walk away.

The problem is, oil wells leak methane, and a lot of it. In fact, that methane is as much as 80 x more potent than carbon dioxoide per kg.

The wells above have up to half a billion dollars in carbon offset potential, which is a massive opportunity, as is the $4+ billion in government incentives recently included in the bipartisan infrastructure bill.

Cow farts and oil wells create a stupid amount of methane, so if a company comes up with a plan that:

- Contributes to a lowering of greenhouse gases..

- Get paid by the government and well owners to clean the wells..

- Obtain carbon credits going forward for having done that work, which can be traded to others for a profit..

I think that’s a pretty good plan.

Here’s the problem:

Your ‘friend’ doesn’t know how to do it.

Cleaning an orphaned well is a skillset that isn’t in great supply (because so few well owners bother), but governments are starting to get a little pissed off at the rusting pipes in farm fields spitting gas, like the one on the right.

Which brings us to Zefiro Methane (ZEFI.CBOE).

These guys have half a century of experience in the oil and gas business, and with much of that involved in clean-up.

They already do business with three US State departments that are giving out contracts to clean these sites up, and Zefiro has plenty – in fact, they’re the largest well remediation outfit in the Appalachian states (PA, NY, OH and WV), and receive a full quarter of all the Pennsylvania-based contracts in this field.

Their management team features people who have built environmental markets divisions at JP Morgan, and others with M&A experience in the oil and gas and environmental offset fields.

AND they’ve already made two acquisitions in the last 12 months AND announced an end user trade agreement for the carbon credits.

The TL/DR version of this is, it’s an orphaned well clean-up roll-up.

And we love a good roll-up.

How do they do it?

Zefiro goes out to an abandoned well and runs some tests for methane. If they find some, this is an addressable local problem. The owner of the well is often incentivized to clean things up and avoid governments looking into their business (or fining them), and if there is no owner about, the government will often want the work done regardless.

Here’s how it looks:

- Decarbonization and Methane Control: Zefiro identifies and curbs harmful methane emissions from end-of-life oil and gas wells by engaging in clean-up and plug-up.

- Asset Retirement Services: Zefiro provides comprehensive services to plug and manage abandoned wells. This is referred to as ‘asset retirement,’ which involves safely closing down these wells that are no longer in use and ensuring they’re properly maintained.

- Environmental Markets: The company leverages their capability to detect and reduce methane emissions to generate carbon credits. These credits can then be sold in environmental markets. This not only helps offset emissions but also turns a potential environmental liability into a revenue stream.

- Scalability and Regulatory Compliance: Their business model is scalable and responds to significant regulatory tailwinds such as penalties for methane emissions, which enhance their market opportunity.

- Synergistic Growth: Zefiro looks to grow by integrating their environmental services with traditional oil and gas well management, creating cross-selling opportunities and expanding their service offerings.

Easy peasy.

Jsut went public on the CBOE exchange (formerly NEO) and doing a ton of volume.

Save the world and make some dough.. nothing wrong with that.

— Chris Parry

FULL DISCLOSURE: Not a client, no financial interest, just spotted in the wild and think it hits a lot of things I like to see existing.