You probably saw my piece about Tisdale Clean Energy (TCEC) yesterday.

In it, I lay out how the guys setting up that deal pretty much seemed to have no interest in the gleaming uranium project they’d brought to market, leaving the company stock at a cheap price, with a shitty looking chart that’ll take some time to shake, and with a CEO tasked with pulling the plane out of decline while everyone who glances at the company writes it off.

It appears, on the back of that piece, some new folks may have jumped into the co-pilots seat and are giving the joystick a pull, because the downward run has leveled off today.

Not to torture the metaphor, but the passengers are cheering. The flight attendants are texting their family, “Just kidding,” after previously sending their goodbyes. Now we wait to see if they can get the belly of the plane off the tarmac again.

There’s a long way to go for Tisdale to be soaring, but I personally think there’s a lot to be said for being able to come in AFTER the deal hyenas have bled a company out, churned through their paper, and found some other carcass to feast on going forward.

Alaska Energy Metals (AEMC) spent $1.5m last year on marketing and promo, and that got the stock running hot for a bit. Everyone made money. If you were on it, you made money, but that cycle has passed.

If $1.5m on promo seems like a lot to you, understand the company also raised $14 million during the good times that promo was working, of which it still has seven figures left to put into drilling going forward.

See, people hate promotional campaigns and complain about the dollars spent, but that $1.5m on Google ads and text messages and whatever else also brought in almost 10x that amount in capital raised.

It’s a dirty business, but not promoting a stock at all isn’t the solution. Understanding what you’re getting into, when you buy a stock, is.

FORGET THE DUMP PHASE.

FORGET THE PUMP PHASE.

And let’s focus on what Alaska Clean Energy is TODAY.

This is what you’re playing for:

Project #1: Nikolai Nickel Project

- Metals: Nickel (Ni), Copper (Cu), Cobalt (Co), Chrome (Cr), Iron (Fe), Platinum Group Elements (PGE)

- Location: Interior Alaska, USA

- Acres on Trend: 9,454 hectares

- Exploration $: Over $30 million spent by historical works on the project

- Historic Holes/Permitted: Data includes results from multiple historic drill programs

- Recent Work: Drilled eight holes in summer 2023; extensive geophysical and geochemical surveys conducted

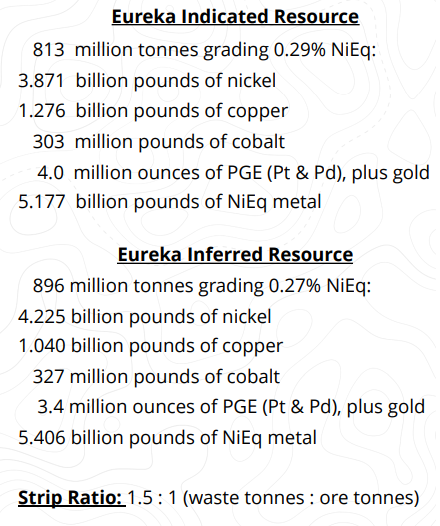

- Compliant Resource Details:

- Inferred: 4.225 billion pounds of nickel

- Indicated: 3.871 billion pounds of nickel

- Measured: Not specified

- Project Origin: Project initially explored by INCO Ltd in the late 1990s; acquired and further explored by Alaska Energy Metals with subsequent data purchases.

Alright, so let’s crank these numbers a bit and see where the value lies.

$30m in work has been done previously, including drilling by AEMC last summer, which makes this property already a bargain right off the outset.

$30m in work has been done previously, including drilling by AEMC last summer, which makes this property already a bargain right off the outset.

A compliant resource estimate is also a solid piece, as it pushes this group further along their timeline to production than most competitors.

For the non-mining-techy folks, a resource estimate is a document that an outside party of experts puts together that calculates with at least some level of confidence what might be lying beneath the ground at the project.

Here, the inferred (some confidence) tally is there’s potentially 4.225b lbs of nickel under the ground. The indicated number (a bit more confidence, but a bit more conservative in its estimation) is 3.871b lbs.

That’s a LOT OF NICKEL, but it’s also a lot of copper, cobalt, and platinum.

It’s great when an explorer has a compliant resource estimate, but when they have one with these sort of numbers, that’s a real win.

In our internal system, we see AEMC as a ‘level 5’ multi-metal explorer, which is a level most exploration companiess don’t achieve in their lifetime.

Last year, money was raised up to $0.50, so the present $0.15 price you can pick it up for is not even 1/3 of what people last year thought was reasonable for this project.

FUTURE PLANS:

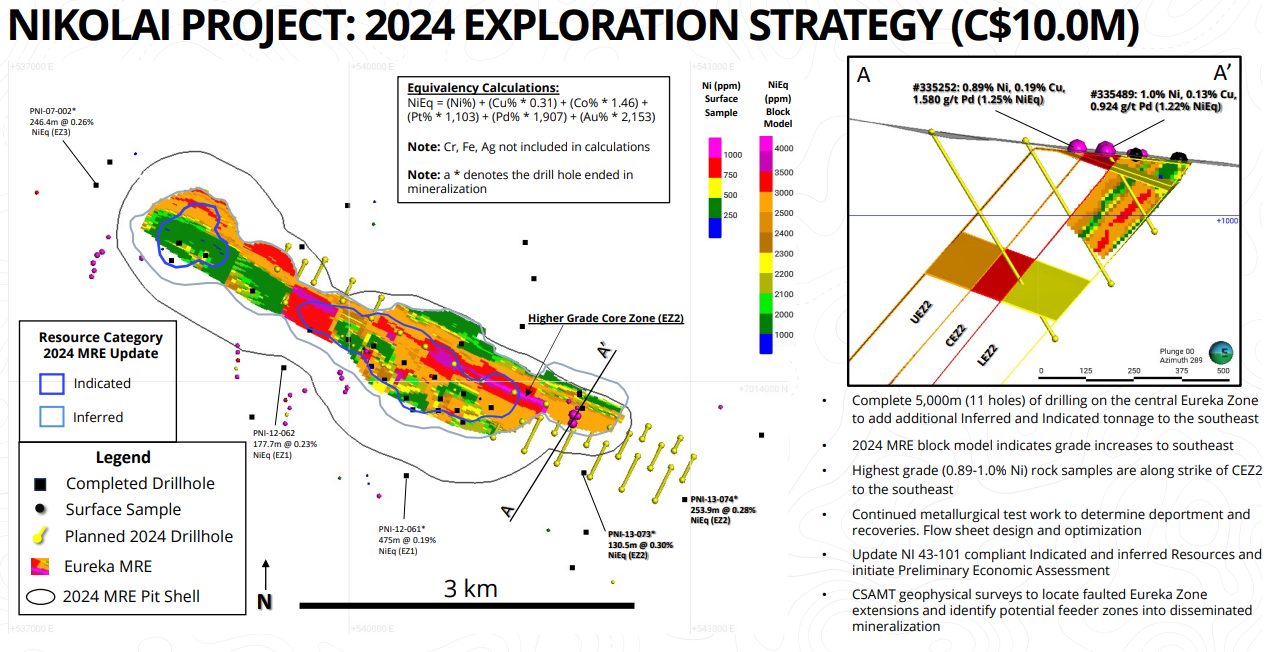

AEMC wants to get in there and pound away on the southeast corner, which they think shows promise to expand the resource. They’re also going to run some along the northern side to see if it’ll break out.

COMPARABLES:

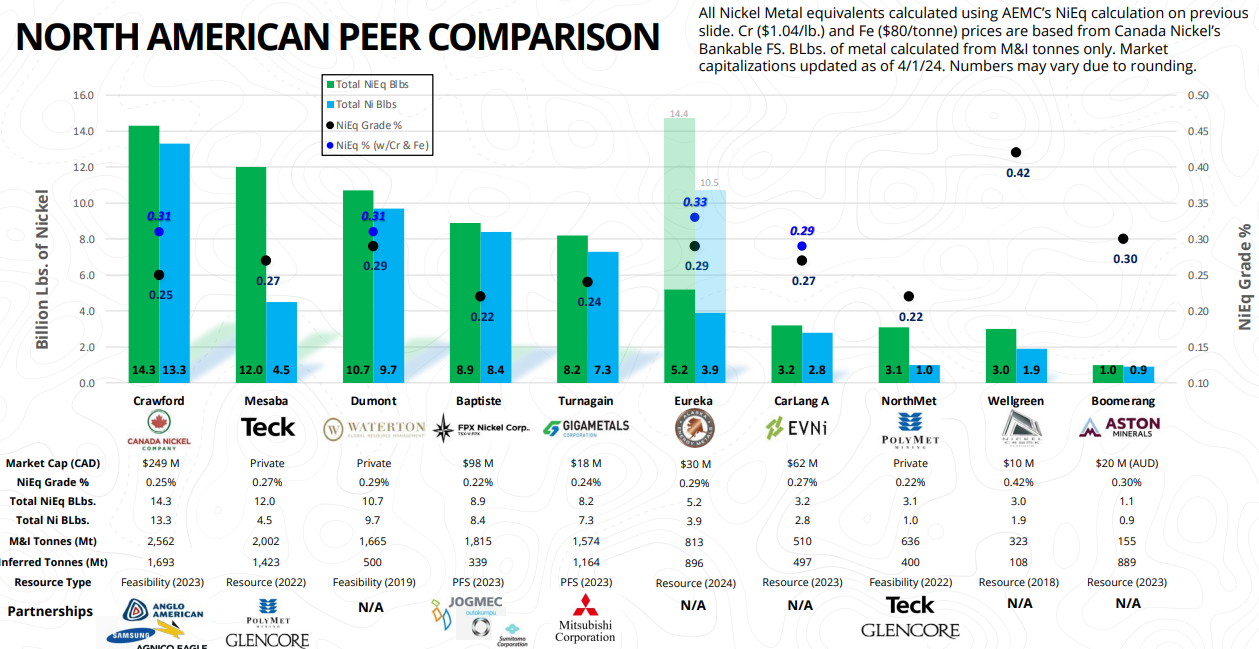

As you can see on the chart below, the AEMC Erueka Zone at the Nikolai project, ranks ahead of the higher market cap $60m EVNi CarLang A project (AEMC sits at $12m currently), and right up behind the Gigametals (GIGA) Turnagain play that is similarly undervalued, and for the same reason as AEMC – it’s been played with by the deal guys to the point where it’s got a bad rep.

How’s that TSLA deal going, Giga? Still waiting.

As you can see, two things stand out:

- If AEMC can find a little more resource in that drilling they’re planning, they move into elevated territory.

- Their 0.29% resource grade currently sits on the high side compared to the big players, with the only folks showing more being very early in their story.

There’s another project they have in Quebec which is no small deal, but early enough that I’m not going to push in no it here, and there are a couple of legacy projects that may be nice spinouts if gold really runs.

But it’s all about the Nikolai right now, and at the price you can buy in, my thinking is you should take a SERIOUS look now that the deal guys have got things out of their system.

To be sure, buying in to a company that has been turnt out in the last six months isn’t always for the squeamish, but I like to look for signs the dust has settled and I see those signs now.

Watchlist.

— Chris Parry

FULL DISCLOSURE: Not a client of mine, but a client of another group that we work well with who paid a small fee for us to look this one over and give our honest impression. My hope is that you see evidence of that in the coverage and, like we have, give the company a good long serious look that we feel the property deserves, while also understanding what you’d be getting into – because that’s really got to be the goal of resource investing; find the good stuff hidden by the bad, buy in cheap when it should be expensive, and have your wits about you at all times.