I’m going to start this by saying Tisdale Clean Energy is not a client. I only mention this because that means I can say whatever the hell I want and if there’s anyone to sue, it’s me alone.

Let’s fucking go.

Tisdale, right now, is a bit screwed. But it’s going to be okay.

I’m going to explain how, why, and by who, but I need your commmitment to stay with me til the end because, though Tisdale is DEFINITELY screwed right now, it’s a temporary thing and could present you with an opportunity to make some nice doughbucks.

Deep breath.. go.

In the academic field of Game Theory there’s an experiment known as the Prisoner’s Dilemma.

In the experiment, two members of a criminal gang are arrested and placed in individual solitary confinement. The police tell each of the prisoners they plan to sentence both to a year in prison on a lesser charge if they can’t figure out who performed the crime. The police also tell each prisoner, if they rat on their partner, they will go free while the partner will get three years in prison. If BOTH prisoners testify against each other, they’ll each get two years in jail.

The obvious solution to this thought experiment is nobody talks, but the slim chance the other prisoner may rat on his friend instills everyone involved with the paranoid notion that it might be best to be the first guy to rat. In the end, nobody can be trusted.

NEWSFLASH: Every single public company that lists on the public markets is the Prisoner’s Dilemma writ large.

Every single one. No exceptions.

Because when a company lists, even when the underlying business is good, even when the people involved are friends, the company invariably lists with human baggage.

For example: One deal guy started the shell and gave hmself 20 million shares at $0.0001 each, he put his friends and family in at $0.005 a share, he owed a guy a favour and sent him a million shares at $0.01, and then the brokers showed up with a company to roll into the shell and take to market, earning themselves a 7.5% finder’s fee while the founder of the new company earns 30 million shares at $0.10 each for agreeing to the deal. Then there’ll be the go-public financing at $0.40, which will be largely filled by marketing guys who will short the stock the moment their paper goes free trading because they know they’re all selling everything the moment they can.

Then YOU come in when it goes public, buying and selling at $0.50 a share for a bit, while all those dirty motherfuckers sell everything.

When that four month hold ends, it doesn’t matter if the company behind the deal is good or bad, because everyone in the deal is so heavily in the money, they’re looking to take profits and reallocate their funds into the next deal.

That’s when the Prisoner’s Dilemma shows up – maybe three of the four early guys think there’s reason to hold. Maybe they LOVE the company. Hell, maybe ALL of them think there’s reason to hold and that the thing will be a ripper over the next few years.

But if one of them sells, and the price duly turns downward, everybody wants out – not because the company is bad, but because “the other prisoners might be talking.”

TO BE CLEAR, THEESE PEOPLE ARENT BORN ARSEHOLES, THE GAME IS JUST DESIGNED TO REWARD ARSEHOLERY.

And that’s before we even get to The Fear.

I recall one vagabond, a bulk buyer of pomade if there ever was one, telling me a few years back the reason he was rolling his company FORWARD as it neared a buck was, he didn’t know what to do with a $1+ stock and had never been there before. So he made it a $0.20 stock to chill his anxieties.

At $0.20, he could get his phone room going. He could get the marketing going. But a dollar stock? Now you have eyes on you.

You wouldn’t think this is a thing because it’s so entirely stupid, but sometimes the deal guys in the Canadian financial markets actually get scared that their company might be real. It’s counter intuitive, but there are a lot of greasy guys out there that will find you financing dollars, take their percentage, then screw your stock up as they take short term gains EVEN AS THEY SEE THE COMPANY COULD BE SUCCESSFUL AND THEIR FRIENDS AND CLIENTS ARE LOCKED IN.

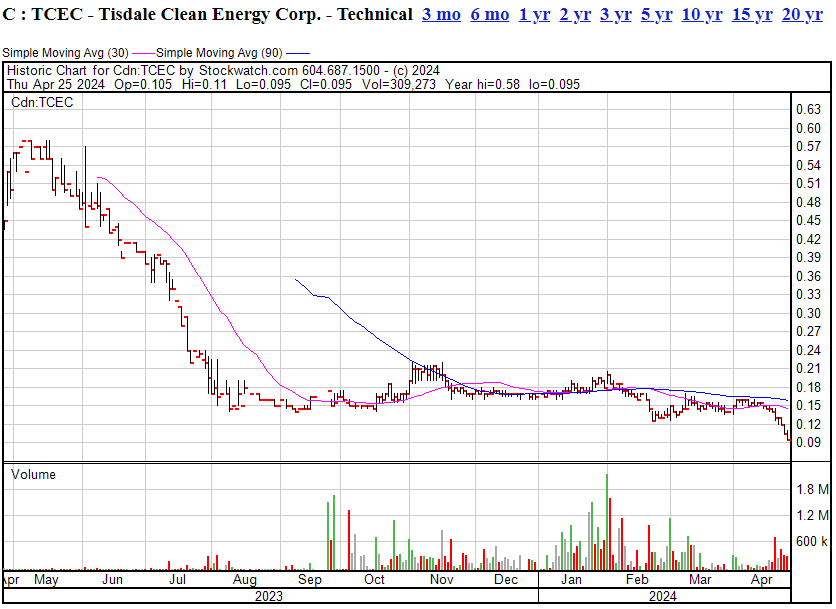

So with all of this in mind, the historic chart behind smallcap uranium explorer Tisdale Clean Energy (TCEC.C) makes perfect sense, when you realize it was historically Deal Guy Concentrate.

Now, this isn’t to say every deal guy is a crook, or even a ‘colourful rogue’; they just do what market guys are designed to do, and what regulators put up with because they’re not equipped to stop it, and it’s not against the rules even if they cared to.

They also knows how to make a stock go up for a time, which is a great skill to have and wins you a lot of friends.

But that stock goes up ONLY for a time.

The problem, historically, is what happens next, and the 2023 chart for TCEC is a pretty good demonstration of what happens when the deal guys move out of a stock.

TCEC made folks some money when the marketing was going on, but it appears nobody – deal guy or investors – at that stage really put much thought into the fact that there’s a good little uranium property there for the exploiting, behind all the paper, if anyone bothered to work it.

And when those deal guys moved on, they left Alex Klenman to step in and try to correct course.

Klenman is what I call an Airbag CEO.

When the car is being driven off the road and the driver and front seat passenger dive out of the doors at 60mph, Klenman is the guy who jumps into the drivers seat from the back and tries to steer clear.

When he’s attached to a deal, he finds investors, he gets work done as a minority holder and everyone is happy, but when suddenly the Camry is hurtling the wrong way down I-94 and the two front doors are open and the steering wheel is spinning wildly, he usually feels a responsibility to not let everyone in the back seat die.

If I was his agent, I’d tell him to stop trying to save everyone’s deals and start being the same every-man-for-himself dude everyone else is making their living being, but that’s not how he’s built, and so he starts every day answering phone calls from investors pissed at things he didn’t do – from multiple companies that would be priced at half a cent if he hadn’t rode in on his white horse when everyone else was scarpering.

The downside is, that sucks as a job.

The upside is, once the flames die down, new growth can happen.

Unfortunately for TCEC, it’s getting deal-fucked right now for a second time. courtesy of some folks from PI, who are selling into the bid with no concern how low things go.

The deal is fucked right now – you totally shouldn’t buy it.

But it’s okay, because opportunity sits at the corner of Promising St and Dumped Ave.

TISDALE CLEAN ENERGY, IN A NUTSHELL:

I’ve been working on a thing that summarizes mining explorers and shrinks them down to a very truncated analysis, so they can be easily compared to other mining explorers at a glance by people too busy (or beaten) to learn about mining technicals. You’ll hear more about it soon, but for now, here’s how TCEC rolls:

Tisdale Clean Energy Corp. is actively involved in the exploration and potential development of uranium and thorium resources in the Athabasca Basin. The company is particularly focused on its South Falcon East property, leveraging recent advancements in exploration methodologies and a historic resource estimate.

Materials Explored For:

- Uranium and Thorium.

Projects:

- South Falcon East Project, Athabasca Basin, Saskatchewan:

- This property hosts a historic uranium deposit, indicating significant potential for resource expansion.

- Recent exploration has included drilling and geological studies aiming to extend known mineralized zones.

Company Level:

- Level 4.1: Active Drilling (early) – Tisdale Clean Energy Corp. has undertaken recent drilling activities that involve more than one but no more than ten holes, totaling 1,720 meters. This activity reflects ongoing development but is still in the early stages of drilling.

Deficiencies:

- To progress beyond Level 4.1, Tisdale would need to either increase the number of drill holes significantly or advance the historical resource to a current mineral resource under NI 43-101 standards.

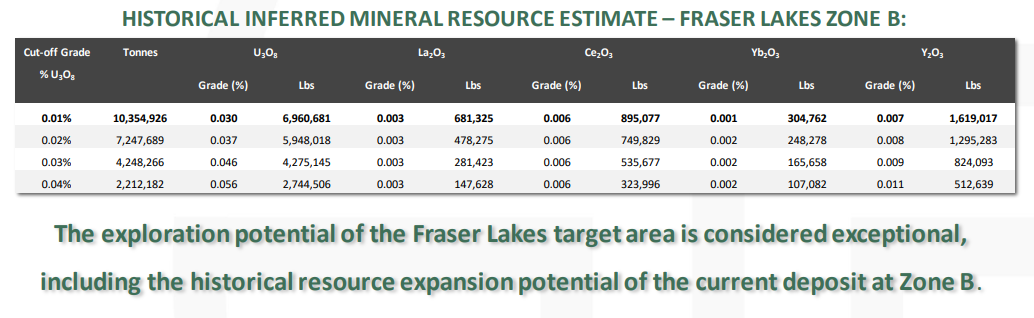

Resource Details:

Neighbouring and Partner Companies:

- Large Neighbours: Adjacent to major players in the uranium market, including Cameco (Market Cap: $23.8B) and NexGen (Market Cap: $5.1B), among others.

Noted Drill Holes and Metres Drilled:

- Recent drilling includes 5 holes in 2015 and 2 holes in 2024, totaling 1,720 meters.

Updated: April 2024

Okay, so what does all that mean for you?

- Tisdale is actively drilling: This puts it ahead of half the comparables in the Athabasca, who like to sniff the ground with spectrometers and listen for a ding but might not be too boithered raising money for drilling, let alone spending the money they raise putting drills in the ground.

- Tisdale has a resource estimate; albeit one that is historic and not currently compliant, like a racing form guide from last Saturday being used to pick a winner on the coming weekend.

- Klenman sticks the landing; He stays in that drivers seat while ears of corn bounce off the windshield and the Goodyears spin in mud, dodging the occasional tractor until the view clears and the car gets back on the road.

So: Work being done on a property with decent provenance, by a guy who has a reputation for being the last one out of the room, in a sector that has traction.

But the key to realizing opportunity is not just in spotting it, but also in the TIMING of your entry.

Get this:

- Last week you could have bought Tisdale stock for $0.15.

- Today you can get it for $0.09.

- And, no, there’s been NO BAD NEWS to trigger that.

If you could buy a Tesla at 1/3 off the price, you would. If you could get a 30% discount on your condo, you’d break the realtor’s arm shaking on it.

But here’s TCEC at a 1/3 discount because some douchelord at PI decided to get his money back now rather than try to arrange a cross.

Yeah, I see you PI, you sloppy, lazy bringers of public markets doom. Clean your act up.

IF YOU’RE KEEPING SCORE:

- Actively drilling

- Historic resource

- Airbag CEO

- Stock at a 1/3 discount

IS THAT ALL?

Nope. Theres one more thing that, to me, makes this an interesting opportunity and that’s MONEYBALL.

You may have seen the movie, you may have even read the book. I live it as a life guidance system.

In essence, Moneyball posits that conventional wisdom is that place in the market where you’re competing with everyone and everyone is competing with you, and because nobody is looking outside of that narrow field, the market misses an awful lot of good shit.

For example:

- Starbucks is popular and big so everyone wants to open a cafe, even though they’ll be competing with that popular and big thing. Let’s open a tea shop.

- Hollywood puts out a movie about an asteroid and it makes money, so next thing you know there are nine movies about asteroids next summer that all lose money while the dark comedy about a plastic doll earns a billion.

- Womens sports have always been spoken of as money losers, until folks actually financed womens sports and found riches in the niches.

How does Moneyball apply to Tisdale?

In the case of Tisdale, the market doesn’t see anything but blood – and it abhors blood.

So instead of buying at lows, the low sellers pick up passengers and more lows are established.

Tisdale has drill holes finding uranium, a historical resource that points to ore in the ground, a CEO doing the work, a share price sliced by 1/3 in a few weeks, AND:

A $2.9 million market cap.

How does this compare to others? Again, I’m going to use my system, which I’ll talk about more in the weeks ahead, to create a sort of PROGRESS metric.

- Bayridge Resources (BYRG) – Has done no drilling, has no resource estimate, is nearby to TCEC: We’ll call that a level 1 with a $43m market cap

- Searchlight Resources (SCLT) – Has done airborne surveys, but no drilling, also not far from TCEC: That’s another level 2, with a $2.3m market cap

- Aero Energy (AERO) – Another neighbour, but has done some early drilling, again no resource estimate, we’re calling this one a level 4.1 with a $13m market cap

And now:

- Tisdale Clean Energy (TCEC) – Has early drilling, is actively working, has a historical estimate: We’re calling this a level 4.1 as well – but has only a $2.9m market cap

That’s BONKERS.

How bonkers?

Let me bring the historic resource estimate info up again.

Let’s be really conservatiuve cranky arseholes who don’t give any credit to anything we can’t prove four times over, and focus on the 0.04% cut-off range listed in the historic numebrs above.

- The inferred numbers show 2.7m lbs of U3o8.

- The market cap of TCEC is $2.9m.

That means when you buy TCEC stock, you’re buying inferred historic uranium in the ground at $1.07 per lb.

Uranium spot sells at $78 per lb as of the time of writing, up from $50 this time last year, and $27 in 2020.

But don’t buy TCEC. Let those weak ass motherfuckers at PI sell what they have into the gaping maw they’ve created, and then let’s pile on this thing and let Klenman powerslide his way around this hairpin.

— Chris Parry

FULL DISCLOSURE: Not a client. No commercial arrangement. But when the bottom hits, gimme that cheap ass historic.