UPDATE: Niocorp has ripped a further $1+ since this article was posted, now sitting at $7 and showing the first signs of profit taking.

We talked up Niocorp Developments (NB.T) eighteen months ago as a rare earths explorer with an elite project, advancing quickly, and rolling into a rich SPAC. It looked pretty darn tasty.

Then it all went sideways, for many reasons.

From a macro perspective, the SPAC market cratered after shady American dealmakers couldn’t help themselves and plundered retail investors mercilessly.

From a micro perspective, the merger took too long, which limited promotion of the company for an extended period, and left SPAC investors wanting their money back.

And they got that money back because the way SPAC deals are structured allows you to pull your money out of a deal once the combo is announced, but before it’s completed. This left NB with barely 10% of the promised $200m in cash that made the deal viable in the first place.

More recently, coimplications in auditing financials when engaging in a cross-border SPAC merger left NB running late on their financials, which further gave investors the sads and cleared the room.

Fast forward to today and the company sits basically where it was when the whole process began, admittedly with a project slightly more advanced, and a stock that’s down 50% on where it had been.

So why mention it here?

Because the project behind it remains EXTREMELY compelling.

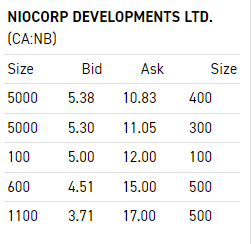

And because the stock was priced at $4.55 a few weeks ago, and hit $5.63 at close today, with a price gap at the close of more than double the current price.

Hey, a gap happens sometimes when a stock slows its roll and there aren’t enough buyers and sellers, but rarely have I seen a gap between bid and ask of $5.45 when the bid is $5.38. In short, nobody is in a hurry to sell NB right now (including me, full disclosure), but there’s still enough buying going on that all the reasonably priced stock has been gobbled up. Icebergs notwithstanding, there are only 1800 shares to be had all the way to $17.

Let’s be clear, icebergs (that is, stock that’s released for sale the moment a buy order comes in) are never actually notwithstanding – chances are, if someone is keen enough to buy some NB at $10.83 and double its share price at the open, there’d suddenly be a lot more stock for sale before that transaction had time to be completed.

UPDATE: There were indeed icebergs, current price action around $7 with similar trading patterns as below.

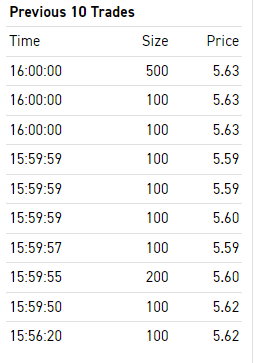

This is why retail investors so frequently end up eating from the smallest bowl, because what you see on your trading screen isn’t what the big boys see. It’s also why you sometimes see a clump of low count transactions happening over a short period rather than one big purchase.. it’s the only way to see what the Level II setup actually looks like.

Let’s be clear – these transactions are not from a wide selection of retail investors randomly all spending $559 at a time buying stock from people selling 100 shares at a time.

Jiggerfuckery to be sure.

That said, gaps this wide are meaningful, especially when the 52 week high for NB was $15.

Buying Niocorp to $15 may seem wild at first glance, but it has been there recently, and it’s not completely unbelievable that it could get there again soon, even with a resource market that is currently fueled on fear, desperation, and overdue invoices from The Brass Rail.

Here’s the TL/DR on Niocorp as we see it:

- Strategic Positioning in Critical Minerals Production: Niocorp aims to produce essential minerals from its Elk Creek project in Nebraska, including niobium, scandium, titanium, and potentially several rare earths. These minerals are fundamental to a variety of industries, from automotive to defense.

- Potential to Dominate the Aluminum-Scandium Market: The company plans to make aluminum-scandium master alloy products (Al-Sc MA) which, when integrated into aluminum alloys, provide stronger, corrosion-resistant, and lightweight alternatives. This unique product can revolutionize sectors such as transportation and defense., and if the Elk Creek project proceeds as planned, Niocorp could become one of the world’s leading producers of Al-Sc MA.

- Addressing the Surge in EV and Hybrid Market: With forecasts suggesting EV/hybrid sales could reach approximately 60 million units by 2030, there’s a considerable demand for lightweight and strong materials like Al-Sc alloy.

- Strong Emphasis on R&D and Commercialization: Niocorp has a phased approach to the commercial production of Al-Sc MA and is currently engaged in pilot-scale production. They have a clear roadmap to commercialization.

- Niocorp’s diverse resource portfolio: This included their exploration into rare earths essential for neodymium-iron-boron (NdFeB) magnets, which positions them well in the growing tech and defense sectors.

They will need to raise hundreds of millions of dollars to get to production, but thats doable if they can get that share price up to $8 or more. Hell, if insiders really want to have investors interested again, buying their own stock on the open market would be one way to do it.

Worth noting at the end of all this: Niocorp already has a willing buyer, should it be able to moe forward to production, and that buyer is an absolute fucking monster.

Stellantis NV and Niocorp Developments Ltd. have signed a rare earth offtake term sheet. The objective is to enter into a definitive rare earth supply agreement to support Stellantis’s commitment to build resilient supply chains and reach carbon net zero by 2038 and to help accelerate Niocorp’s path to commercial production of magnetic rare earth oxides in the United States.

The term sheet executed today envisions a definitive agreement for a 10-year offtake contract for specific amounts of neodymium-praseodymium oxide, dysprosium oxide and terbium oxide that Niocorp aims to produce at its Elk Creek critical minerals project in southeast Nebraska, subject to the receipt of adequate project financing. Final volumes would be set in a definitive agreement.

Mark my words, if Niocorp can take this to a definitive agreement, they can take that to any bank and finance the move to production/.

My suspicion is this deal might be closer than people think.

— Chris Parry

FULL DISCLOSURE: Not a client company, though it has been in the past, and we own some stock.