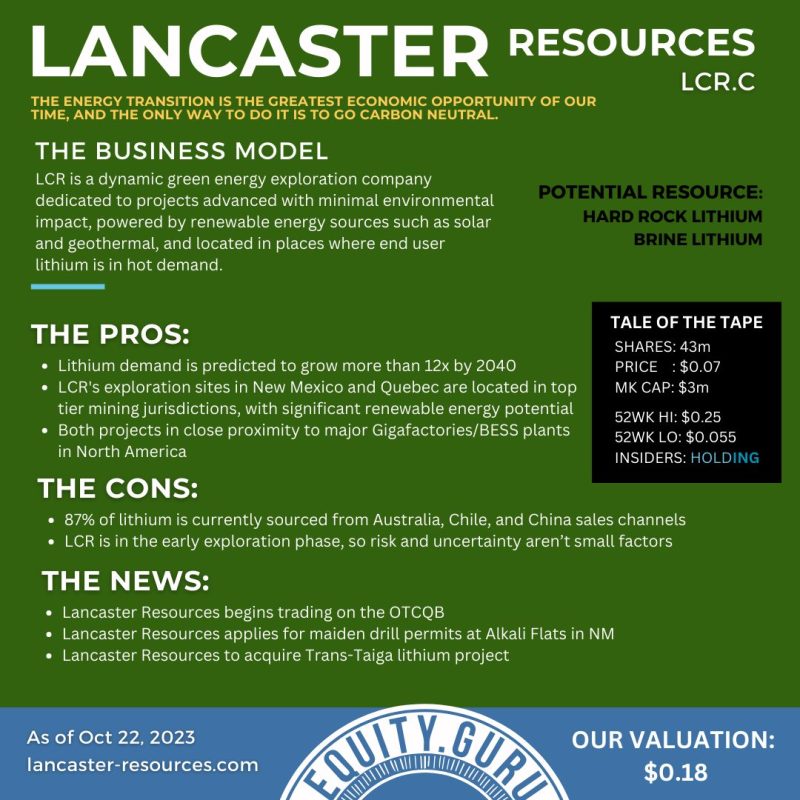

Lancaster Resources (LCR.C) attracted no attention the first time we mentioned it.

“Oh, cool, another lithium project, how original,” barked the usual naysayers in the usual places naysayers say nay.

But Penny White has faced down the cynics before, plenty of times (including some we’ve reported on), but she’s not infamous for fading away. Rather, she’s infamous for going to war for her companies.

Anyways, never count her out. This past week has been Lancaster time, with the stock shifting from $0.055 to $0.07 with strong volume.

- The locations of their projects: New Mexico and Quebec are both top-tier mining jurisdictions with Quebec Pegmatite being globally sought-after and New Mexico’s areas underexplored for Lithium brines.

- The company’s commitment to renewable energy: New Mexico is a hub for solar and wind energy, and Quebec generates nearly all its electricity from hydro power.

- The strategic focus on lithium: Given its crucial role in modern technology and its projected demand surge, LCR’s focus on lithium exploration is timely and relevant.

Add in a #4: Penny White has something to prove, and in her first handful of months on this deal, she’s been making moves.

Here’s the core story.

A $0.07 stock being slated to head to $0.18 might seem like a big leap for some, but our thinking on this play is LCR has a chance to show NM isn’t just pegamatite country. There hasn’t been a brine discovery there of consequence, mostly because few have been looking.

But LCR geos think the same historic shifts that brought lithium to the Clayton Valley started their journey downfield in NM, and with a US jurisdiction that isn’t averse to resource exploration, mixed in with essentially Mexican weather, they’re rolling the dice that there’s something to look at here.

And at a $3m market cap currently, it won’t take much good news to revalue this thing accordingly.

— Chris Parry

FULL DISCLOSURE: Lancaster Resources is an Equity.Guru marketing client. Our valuation is based on where we think the stock price could move given moderate to significant good news, project advancement, and ongoing market awareness over the coming three months.