After a month that Plurilock (PLUR.V) shareholders would rather forget stock-price-wise, the big brains at PLUR-HQ have dropped two pieces of news, both of which are substantial in my opinion.

The first is, potentially a monster:

Plurilock’s snared a patent approval for its core product, which follows a computer user’s rhythms, habits, typing style, and dozens more metrics besides to determine if the person at the computer is actually who they should be, in an ongoing basis. This ability to move forward from single-login ID to constant verification, seamless to the user, is bringing ongoing and new contracts with astonishing regularity, so having a patent on it is great news.

The details:

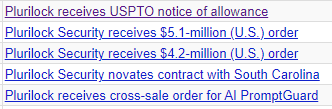

- Patent Achievement: Plurilock Security Inc. has secured approval from the U.S. Patent and Trademark Office (USPTO) for a new technological advancement.

- Specifics of the Patent: It pertains to “Side-Channel Communication Reconciliation of Biometric Timing Data for User Authentication During Remote Desktop Sessions.” This essentially is a method that uses behavioral-biometrics to authenticate users during remote desktop activities.

- Application of the Technology: This technology, known as Plurilock’s Defend, is particularly beneficial for entities that handle or are obligated to protect sensitive data.

- Statement from Leadership: Ian L. Paterson, the CEO of Plurilock, expressed satisfaction with this development, emphasizing the company’s commitment to expanding its portfolio of innovative, AI-driven cybersecurity solutions.

My take: The market may not register this as the big deal it is, but PLUR’s AI driven ability to monitor usage patterns and figure out when someone from IT should drop by Phil from Accounting’s terminal and make sure it’s him sitting there during his lunch break, is potentially game changing, especially at a time when computer security is so important AND so regular beaten.

In addition, PLUR has a financial update:

- Extended Credit: Plurilock’s subsidiary, Aurora Systems Consulting Inc., has been approved to expand its line of credit. It has increased from $4 million to $7 million.

- Lending Entity: This line of credit is provided by Pathward National Association, previously known as Crestmark, which operates under the umbrella of MetaBank National Association.

My take: This will be a blip on the radar of most people – $3m in loan potential is, for a lot of companies, no big deal. But Plurilock has been moving to profitability for some time – albeit slowly – and getting an extra quarter or two of runway means there’s less of a panic to get there.

Plurilock announces new contracts and renewed contracts, and government contracts, every other week, but the annualized revenues positively dwarf the market cap.

It’s projecting an annualized $56m in revenue (based on the last six months) with a market cap of just $8m, and 6-monthly revs up 72% since last year. Q2 losses were $2.58m, which is a small gap to make up. The LOC increase grants the company some breathing room, but with their tech now patented, that may open up other revenue streams going forward.

Stock is at $0.085 now, which we see as oversold.

— Chris Parry

FULL DISCLOSURE: Plurilock is a former Equity.Guru marketing client and we own the stock